UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box: | | | | | |

| ☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | Definitive Proxy Statement |

| |

| ☐ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material Pursuant tounder §240.14a-12 |

HILTON WORLDWIDE HOLDINGS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)(check all boxes that apply): | | | | | | | | |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

20222024 PROXY STATEMENT

for Annual Meeting of Stockholders

| | | | | |

| April 8, 2022 |

Dear Stockholders: | |

| 5, 2024 |

In 2021,Dear Stockholders:

With travel booming in 2023, our Hilton family ofincredible Team Members, dedicated owners and trusted partners around the globe once again did their part to make the world brighter – and Hilton stronger – during adelivered another exceptional year of changehospitality for our guests.

During the year, we opened more than a hotel a day, launched two new brands – Spark by Hilton and challenges. Through it all, we’ve been guidedLivSmart Studios by Conrad Hilton’s founding visionHilton, introduced new innovations, and expanded partnerships to shareprovide more experiences for our guests. We celebrated the lightglobal debut of both Spark by Hilton and warmthTempo by Hilton. The opening of hospitality around the world.

Our Team Members’ continued resilience and innovationSpark by Hilton Mystic Groton represented the fastest announcement-to-launch brand in the face of a changing pandemic ensuredHilton history. Overall, we’re proud to say that we remained focused onopened 395 hotels, totaling approximately 63,000 rooms.

Even with robust openings, our pipeline reached the future, energized byhighest level in our history. At year-end, our pipeline totaled over 462,000 rooms with roughly half under construction following a strong year in construction starts.

Thanks to the belief that we shine brighter together.

strength of our brands and our signature hospitality, our more than 180 million Hilton Honors members enjoy exclusive rates, singular experiences with our partners, and many more benefits. As a business of people serving people,our guests’ travel preferences have evolved in recent years, we remain focused on providing reliabledelivering on our Customer Promise through digital solutions and friendly serviceinnovative on-property experiences and products.

With wellness taking center stage, our expanded partnership with Peloton and our newest lifestyle brand Tempo by Hilton cater to the modern traveler wanting to keep up their routines while on the go. The ways people travel have changed too, and through an expanded agreement with Tesla, we’ll see the installation of up to 20,000 charging stations at 2,000 hotels in North America, addressing growing electric vehicle travel.

And when it comes to business travel, our guests aroundnew Hilton for Business program offers faster check-ins, personalized preferences and exclusive rewards for small- and medium-sized businesses, which make up a growing and important part of our loyal customer base.

Importantly, Hilton’s purpose and world-class culture are at the world. Overheart of what we do. We strive to be a beacon of hope and an engine of opportunity for everyone we serve and believe that our hospitality has the last year,power to change lives. And we launched several new industry-leading offeringshave a responsibility to provide guests with more choice and control, while allowing our Team Members and communities to focus on creatingsupport them. In 2023, we celebrated being named the experiences we’re known for. Some of our recent innovationsNo. 1 World’s Best Workplace by Great Place to Work and enhancements include:

•Digital Key Share, which allows more than one guest to use their room’s Digital Key;

•Automatic, complimentary room upgrades for Elite Hilton Honors Members, available directlyFortune magazine and have now been on the Hilton Honors app; and

•Confirmed Connecting Rooms, solving a long-time frustration for guests by enabling them to book guaranteed connecting rooms seamlessly.

Our 128 million Hilton Honors members are our most engaged and loyal guests, and given the dynamic travel environment, we also extended their current loyalty program status through March 2023. At the same time, we’ve made exciting progress in growing our global footprint in 2021, achieving a robust net unit growth of 5.6 percent versus last year. We opened more than one new hotel per day across all markets and regions, including:

•Our return to the Las Vegas strip with the opening of Resorts World Las Vegas, bringing all our luxury brands to this exciting market;

•The expansion of our luxury and lifestyle footprint with the first Canopy by Hilton properties in Spain and France, as well as introducing LXR Hotels and Resorts in Asia Pacific and Africa;

•The debut of our premier meetings and events focused brand – Signia by Hilton – with the conversion of the Hilton Orlando Bonnet Creek; and

•Opening the 500th Home2 Suites by Hilton worldwide and the first in China – making it one of the fastest-growing brands in industry history.

Our hotels become part of the fabric of the communities we serve, and even through trying times, Hilton's hospitality continues to be a force for good. Our Hilton Effect Foundation announced new grants in 2021, pledging $1.5 million to organizations committed to restoring the planet and our communities.

We’re also proud to be recognized for our global leadership in sustainability, and were included on both the World and North Americaprestigious Dow Jones Sustainability Indices for the fifth consecutive year. And, as people reevaluate what mattersseven years running.

As we look into 2024 and beyond, we believe Hilton is poised for continued success, powered by our incredible team. We look forward to themwelcoming you into our hotels in the workplace, Hilton maintained its standing as a leading employer, reflected in our recognition from Fortune and Great Place to Work as the #1 Best Big Company to Work For in the U.S., the #1 Great Place to Work for Women in the U.S. and #3 on the list of the World’s Best Workplaces.

We were also honored to be recognized for our enduring commitment to building an inclusive culture for our Team Members, earning the top spot on DiversityInc’s Top 50 Companies for Diversity list.

You can find more information in our proxy statement and annual report. We also invite you to attend our Annual Meeting of Stockholders on May 20, 202215, 2024 at 9:00 a.m. EST.EDT. Your vote is important to us. Whether you own a few shares or many, and whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the meeting.

Thank you for your continued support and investment in Hilton.

Sincerely, | | | | | |

| |

| Jonathan D. Gray | Christopher J. Nassetta |

| Chairman of the Board of Directors | President and Chief Executive Officer |

HILTON WORLDWIDE HOLDINGS INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | |

TIME | 9:00 a.m., Eastern time, on May 20, 2022 |

| |

PLACE | Conrad Washington, DC, 950 New York Avenue, NW, Washington, DC 20001 |

| | |

ITEMS OF BUSINESS | 1. | To elect the director nominees listed in the proxy statement. |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2022. |

| 3. | To approve, in a non-binding advisory vote, the compensation paid to our named executive officers. |

| 4. | To consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

| |

RECORD DATE | You may vote at the Annual Meeting if you were a stockholder of record at the close of business on March 25, 2022. |

| |

VOTING BY PROXY | To ensure your shares are voted, you may vote your shares over the Internet, by telephone or by requesting a proxy card to complete, sign and return by mail. Internet and telephone voting procedures are described on the following page, in the Questions and Answers section beginning on page 58 of the proxy statement and on the proxy card. |

| | | | | |

| By Order of the Board of Directors, |

| |

| Kristin A. Campbell |

| Executive Vice President, General Counsel, Chief ESG Officer and Secretary |

This Notice of Annual Meeting and Proxy Statement are first being distributed or made available, as the case may be, on or about April 8, 2022.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 20, 2022: This proxy statement and our annual report are available free of charge at www.proxyvote.com, a site that does not have “cookies” that identify visitors to the site.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | |

| TIME | 9:00 a.m., Eastern time, on May 15, 2024 |

| |

| PLACE | Conrad Washington, DC, 950 New York Avenue, NW, Washington, DC 20001 |

| | |

| ITEMS OF BUSINESS | 1. | To elect the director nominees listed in the proxy statement. |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024. |

| 3. | To approve, in a non-binding advisory vote, the compensation paid to our named executive officers. |

| 4. | To consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

| |

| RECORD DATE | You may vote at the Annual Meeting if you were a stockholder of record at the close of business on March 22, 2024. |

| |

| VOTING BY PROXY | To ensure your shares are voted, you may vote your shares over the Internet, by telephone or by requesting a proxy card to complete, sign and return by mail. Internet and telephone voting procedures are described on the following page, in the "Questions and Answers" section beginning on page 55 of the proxy statement and on the proxy card. |

| | | | | |

| By Order of the Board of Directors, |

| |

| Anne-Marie W. D'Angelo |

| Executive Vice President, General Counsel and Secretary |

This Notice of Annual Meeting and Proxy Statement are first being distributed or made available, as the case may be, on or about April 5, 2024.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 15, 2024: This proxy statement and our annual report are available free of charge at www.proxyvote.com, a site that does not have “cookies” that identify visitors to the site.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

VOTING INFORMATION

If at the close of business on March 25, 202222, 2024 you were a stockholder of record, you may vote your shares by proxy in advance of the 20222024 Annual Meeting of Stockholders (the “Annual Meeting”) through the Internet, by telephone or by mail. Alternatively, you may vote in person at the Annual Meeting. For shares held through a broker, bank or other nominee, you may vote by submitting voting instructions to your broker, bank or other nominee. Please refer to information from your broker, bank or other nominee on how to submit voting instructions. To reduce our administrative costs and help the environment by conserving natural resources, we ask that you vote through the Internet or by telephone, both of which are available 24 hours a day. You may revoke your proxies at the times and in the manners described in the “Questions and Answers” section beginning on page 5855 of the proxy statement. If you are a stockholder and are voting by proxy by Internet or by telephone prior to the Annual Meeting, your vote must be received by 11:59 p.m., Eastern time, on May 19, 202214, 2024 to be counted.

To vote by proxy prior to the Annual Meeting:

BY INTERNET

•Go to the website www.proxyvote.com and follow the instructions, 24 hours a day, seven days a week.

•You will need the 16-digit number included on your Notice of Internet Availability of Proxy Materials or proxy card to vote online.

BY TELEPHONE

•From a touch-tone telephone, dial 1-800-690-6903 and follow the recorded instructions, 24 hours a day, seven days a week.

•You will need the 16-digit number included on your Notice of Internet Availability of Proxy Materials or proxy card in order to vote by telephone.

BY MAIL

•If you did not receive a printed copy of the proxy materials, request a proxy card from us by following the instructions on your Notice of Internet Availability of Proxy Materials.

•When you receive the proxy card, mark your selections on the proxy card.

•Date and sign your name exactly as it appears on your proxy card.

•Mail the proxy card in the enclosed postage-paid envelope provided to you.

YOUR VOTE IS IMPORTANT TO US. THANK YOU FOR VOTING.

TABLE OF CONTENTS

HILTON WORLDWIDE HOLDINGS INC.

7930 Jones Branch Drive, Suite 1100, McLean, Virginia 22102

Telephone: (703) 883-1000

PROXY STATEMENT

Annual Meeting of Stockholders

May 20, 202215, 2024

PROXY SUMMARY

20212023 COMPANY PERFORMANCE HIGHLIGHTS

PERFORMANCE ON OUR KEY STRATEGIC PRIORITIES

| | | | | | | | | | | | | | | | | | | | | | | | | | |

LEAD WITH OUR CULTURE | | | | | | | | |

| #1 World's Best Big CompaniesWorkplace and #1 Best Workplace for Women in the U.S. by Great Place to Work For and #3 World’s Best Workplace – highest ranked

hospitality companyFortune magazine

| | #1 Top 50 Companies

Received 100% rating in the Corporate Equality Index from the Human Rights Campaign for Diversity – 7ththe 10th year in a row on

| | Awarded over $4.4 million in Hilton Global Foundation grants to organizations supporting destination stewardship, climate action, career development and community resilience | | Named to the list | | Announced new

diversity and

inclusion commitments

and disclosed

current progress | | RecognizedDow Jones Sustainability Indices ("DJSI") as a global

sustainability leader by being included onfor the Indices for the

57th year in a row

|

| | | | | | | | |

| | | | | | | | |

EVOLVEWIN WITH OUR

CUSTOMER

EXPERIENCECUSTOMERS

| | | | | | | | | | | | |

| Continued to design the Hotel of the

Future, with 5,600+ hotels using

Digital Key to open 57M+ doors

worldwide in 2021 | | Introduced innovations for our

Hilton Honors loyalty program,

including Elite Automatic

Upgrades, Digital Key Share and

Confirmed Connecting Rooms

booking feature | | Gained 15M+28.6M new

Hilton Honors members,

bringing total

membership to 128M,180M, a

13% 19% year-over-year

(“YOY”) increase | | Waldorf Astoria ranked #1 luxury brand and Home2 Suites ranked #1 upper midscale/midscale extended stay brand by JD Power’s 2023 North America Hotel Guest Satisfaction Index | | Developed Hilton for Business, which offers faster check-ins, personalized preferences and exclusive rewards for small- and medium-sized businesses | | Partnered with Mars Petcare

companies and declared pet-friendly

commitments at all Extended

Stay propertiesevents including the Chelsea Football Club, Formula 1, the Ryder Cup and the Grammys to provide experiential opportunities to our Hilton Honors members |

| | | | | | | | |

| | | | | | | | |

ENHANCE OUR NETWORK EFFECT | | | | | | | | |

| Opened 1st Signia, 501,000th Tapestry,

100 Hilton Garden Inn, 250th Tru and 300th Lifestyle Hotel, including 150th Curio and

2,700th Hampton

| | Opened the 3,500 room multi-brand Resorts World

Las Vegas

| | Opened 400700th

hotel in APAC, including the 300th Hampton in Greater China | | Launched new extended-stay brand LivSmart Studios | | Opened our 500thHome2 Suitesthe first Spark, fastest announcement-to-launch brand in Hilton history, Tempo and 1st in

China, making it one of the

fastest growing brands in

industry history

new build Signia |

| | | | | | | | |

| | | | | | | | |

MAXIMIZE OUR PERFORMANCE | | | | | | | | |

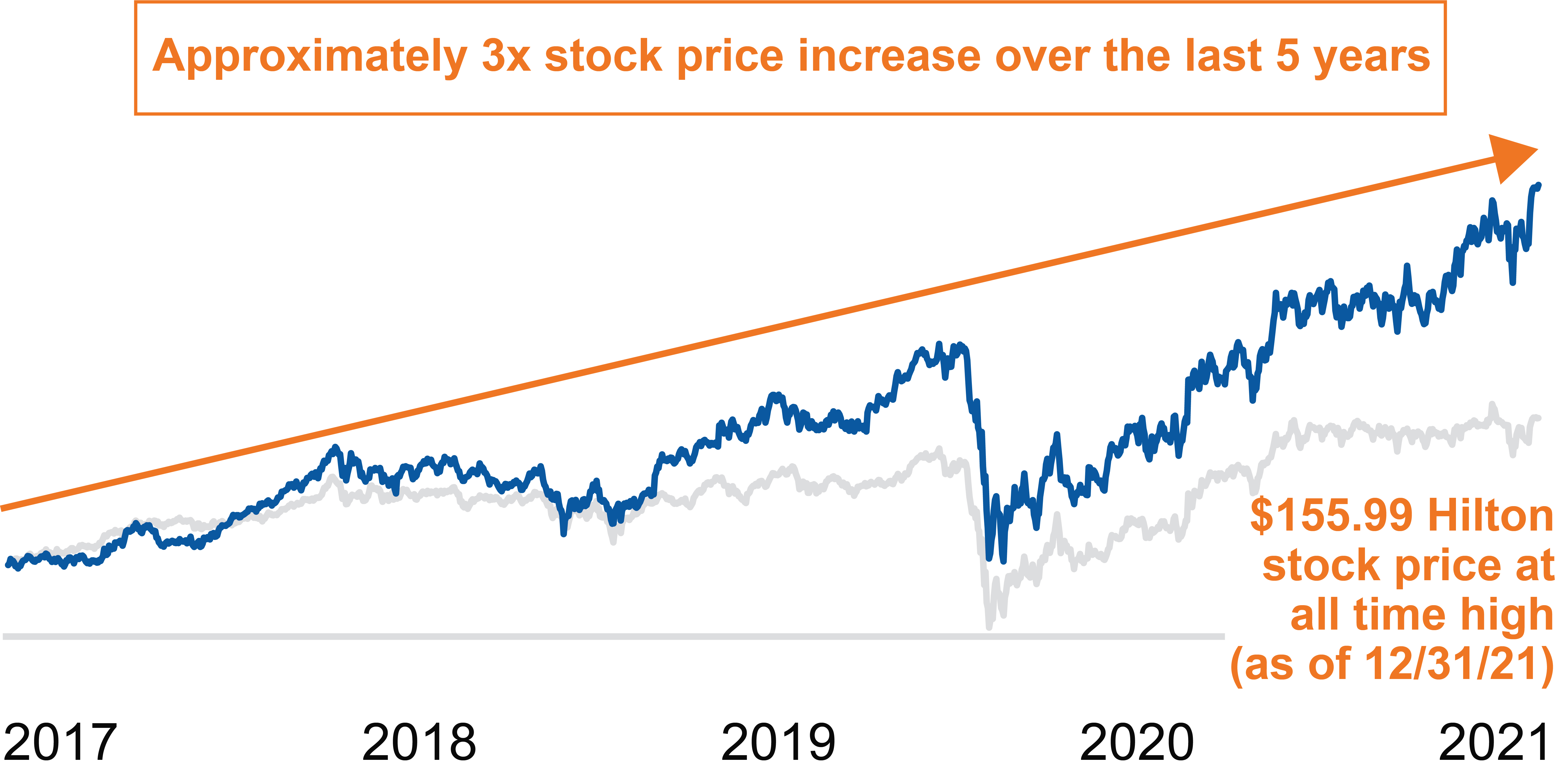

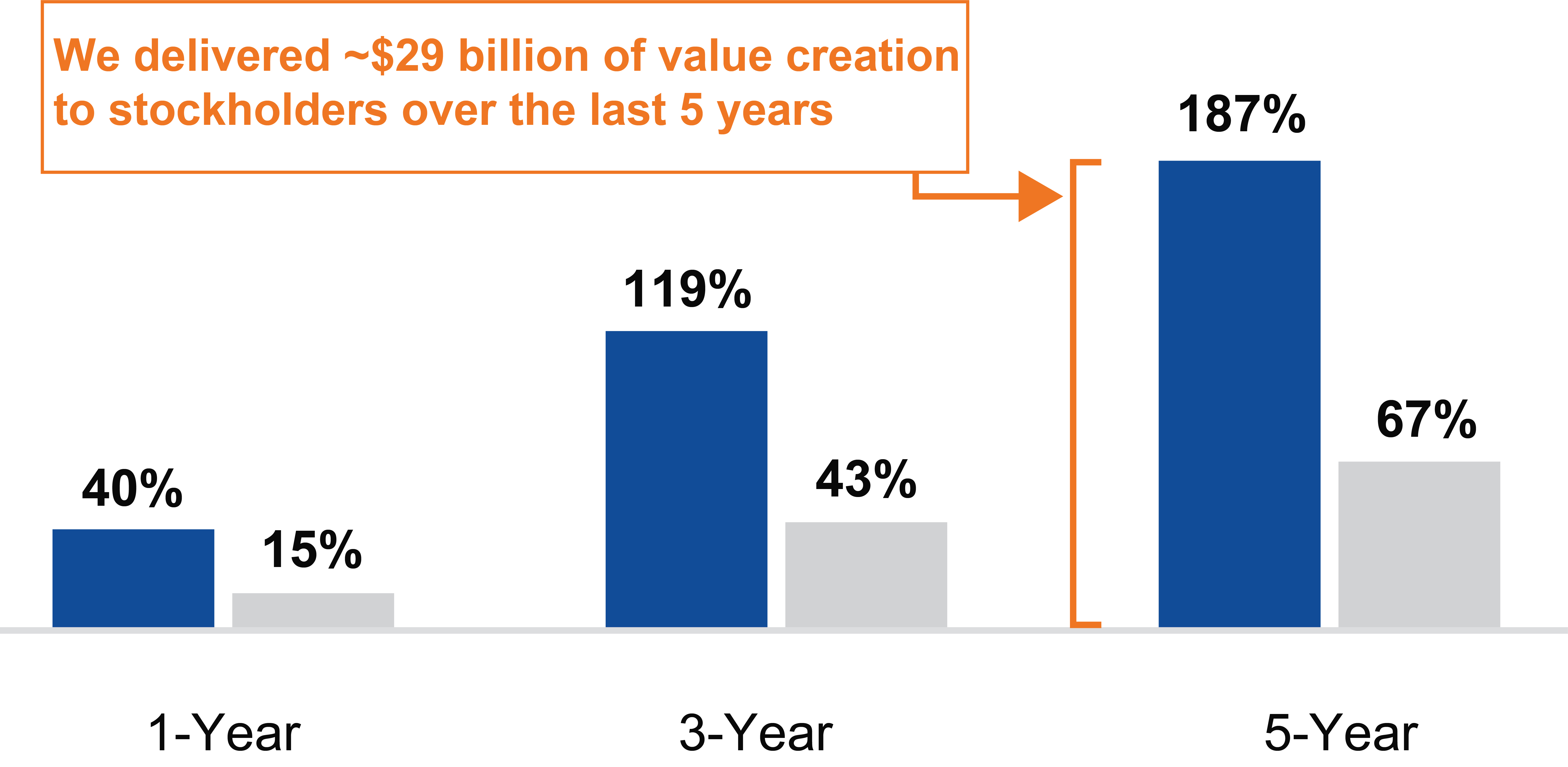

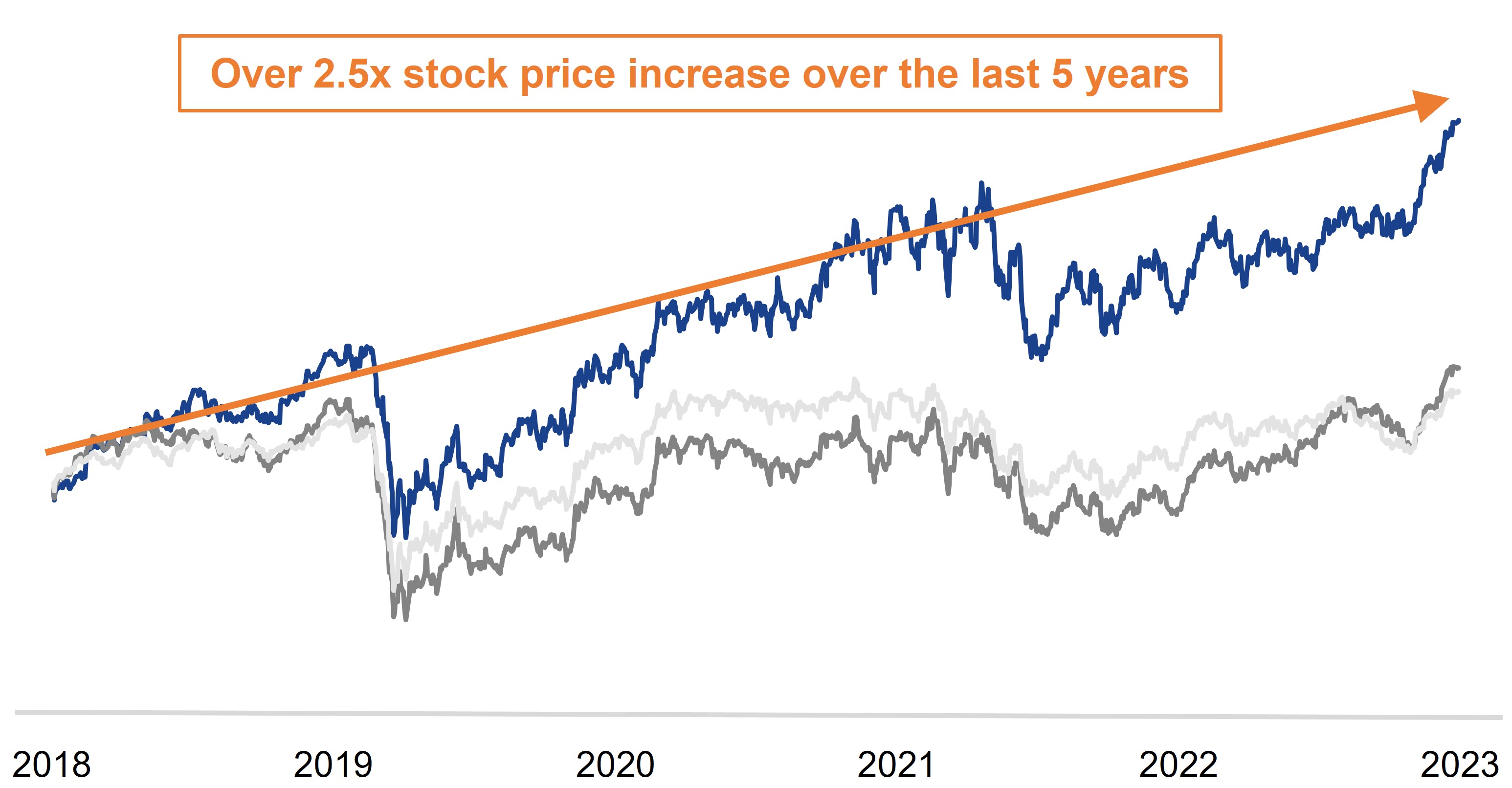

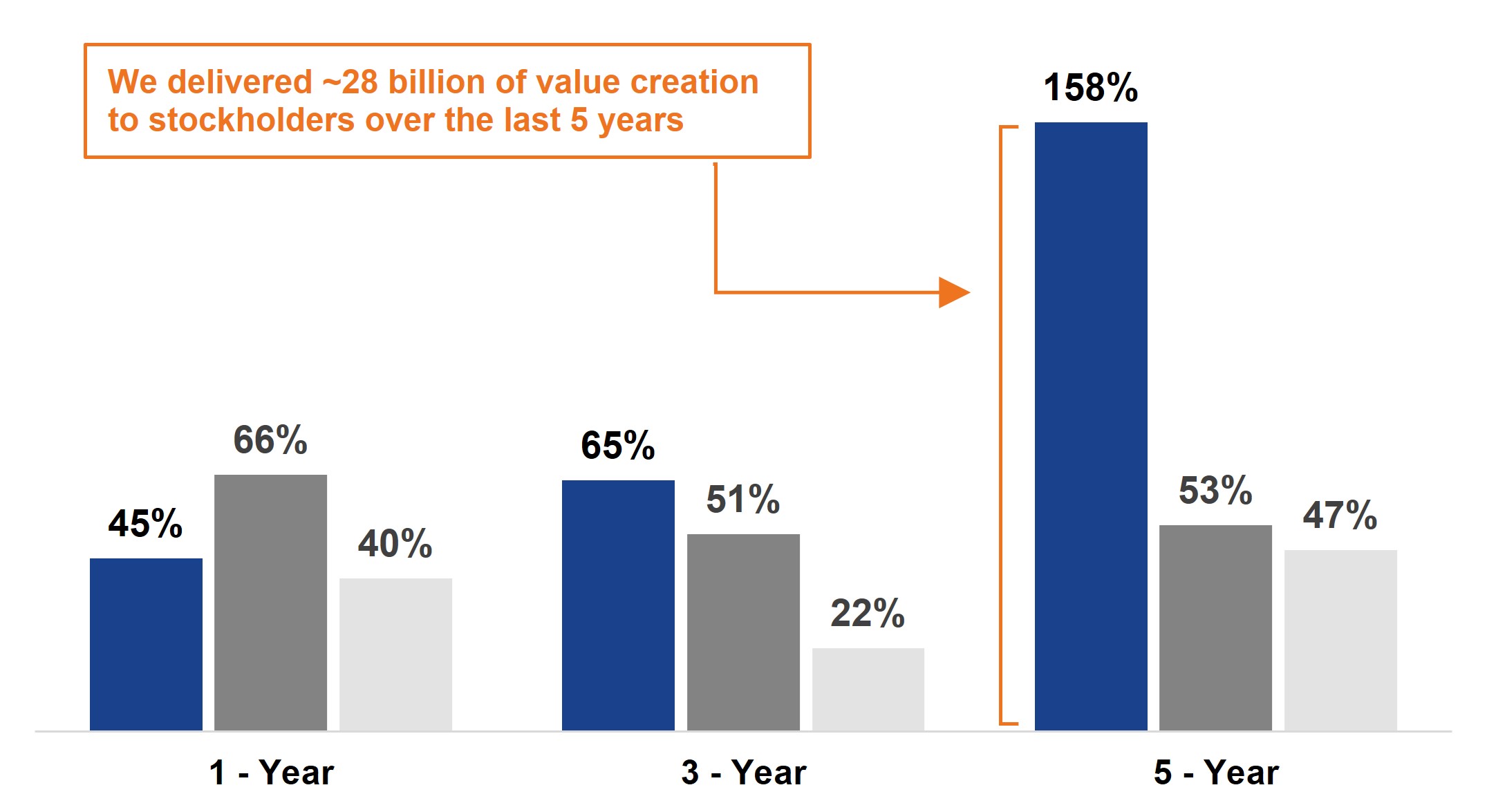

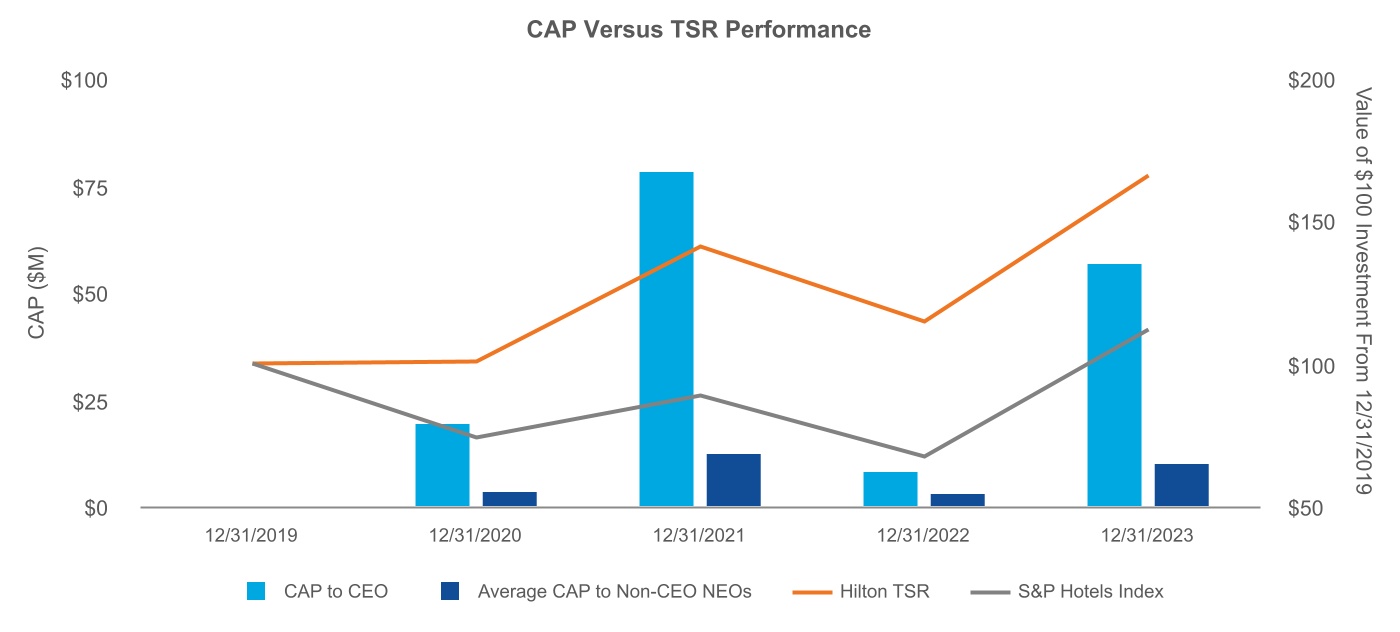

| Delivered $29 billion5-year Total Stockholder Return ("TSR") was 158%, delivering nearly $28B of value creation

to stockholders over the last 5 years(1)

| | Through our capital return program, returned $2.5B to shareholders including through share buybacks and dividends | | Designed elevated retail spaces for Hilton Garden Inn, Homewood SuitesCompleted $3.1B in refinancing extension and

Tempo brands upsizing of our Term Loan Facilities and upsized and extended our borrowing capacity on our Revolving Credit Facility to $2B | | Relaunched

“Top of Bed”

programs | | Launched GroupSync

Engage, an integrated

solution for booking group

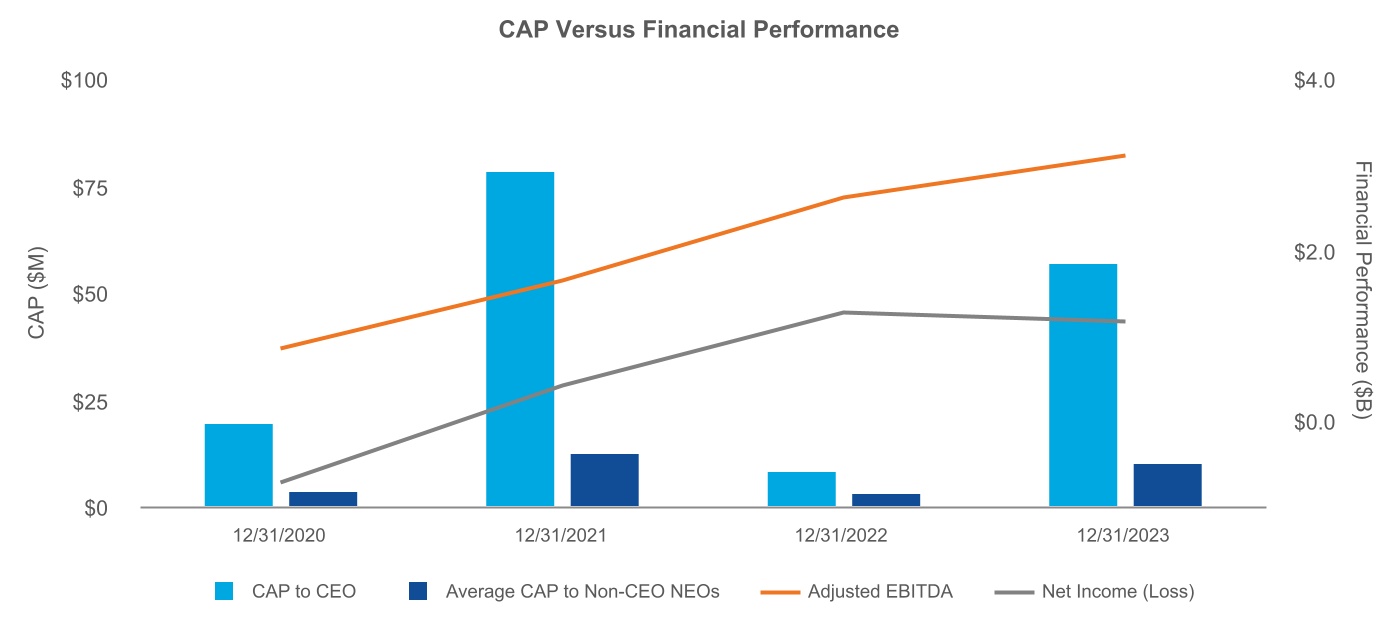

room blocksIncreased Adjusted EBITDA margin 50 basis pts. YOY to 69.4%(2) |

FINANCIAL & DEVELOPMENT PERFORMANCE

| | | | | | | | | | | | | | |

| | | | |

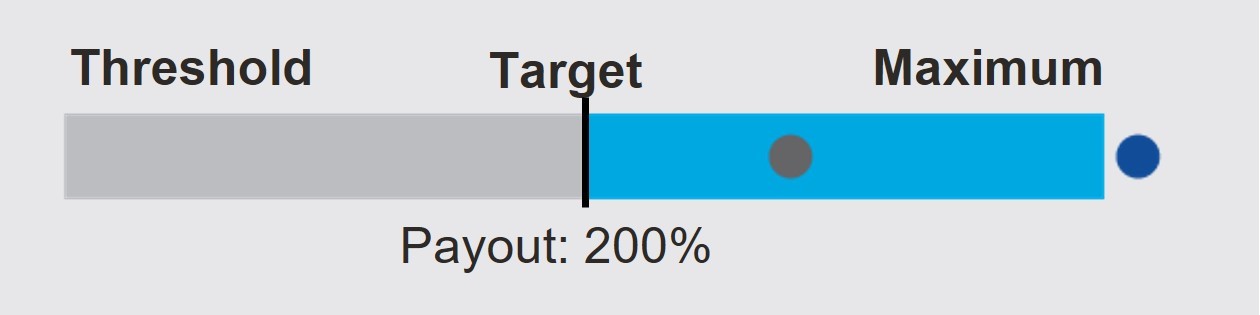

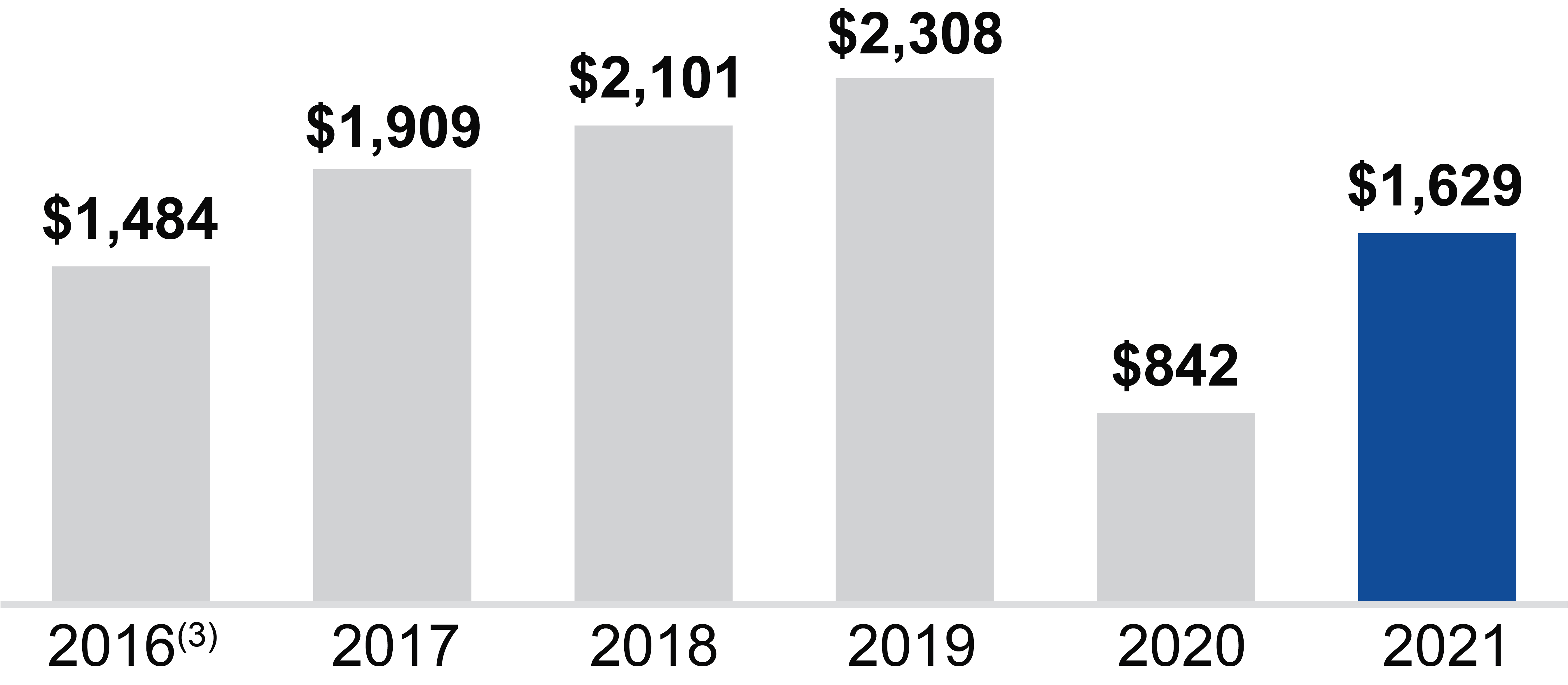

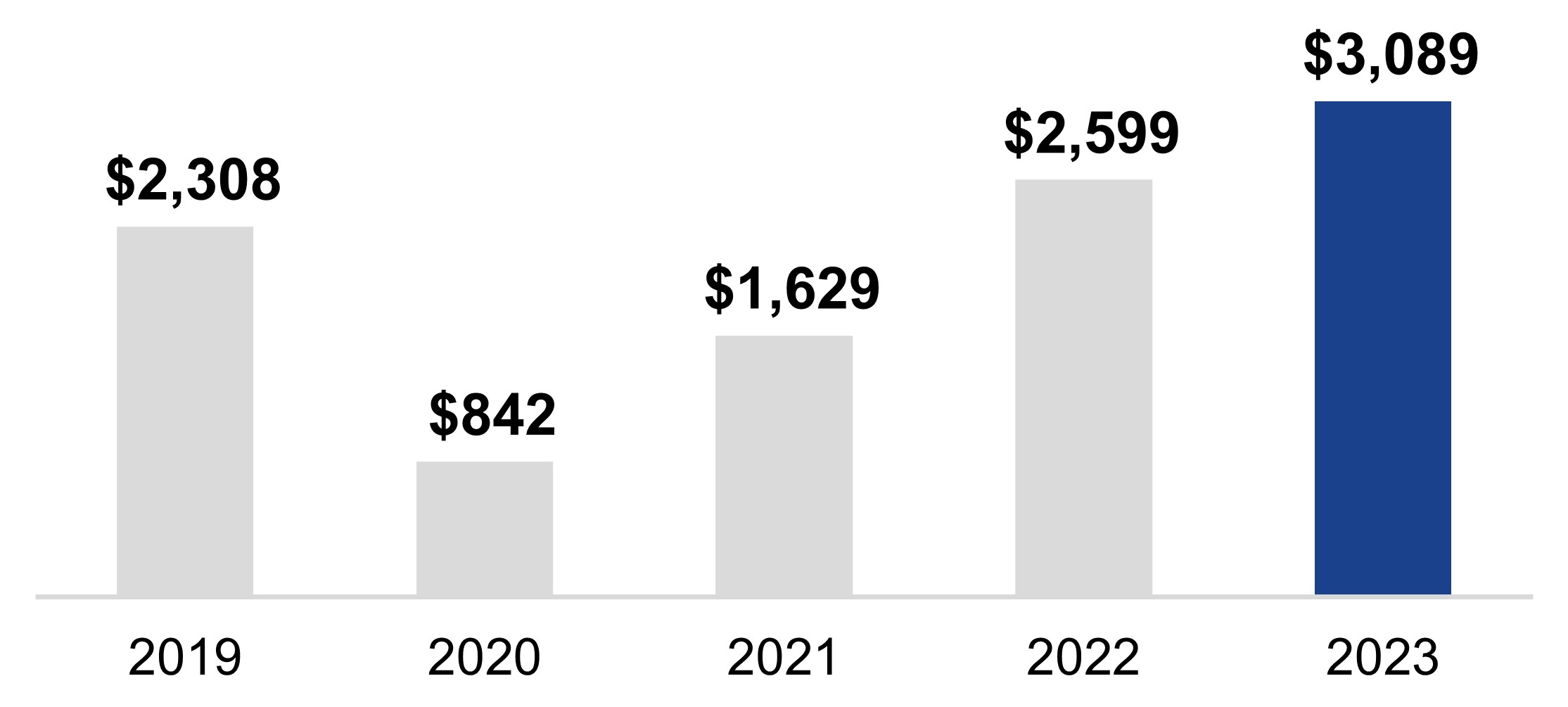

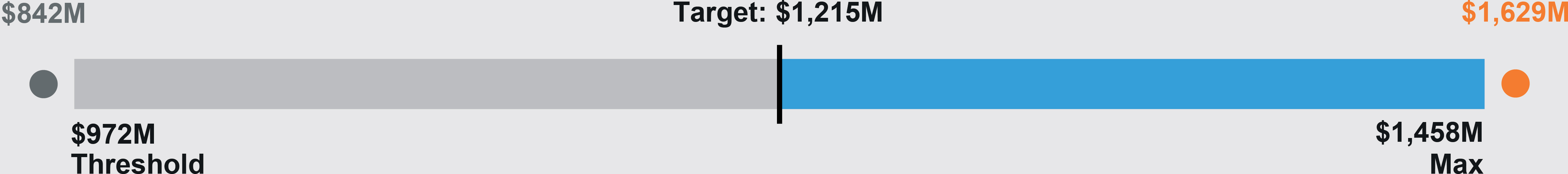

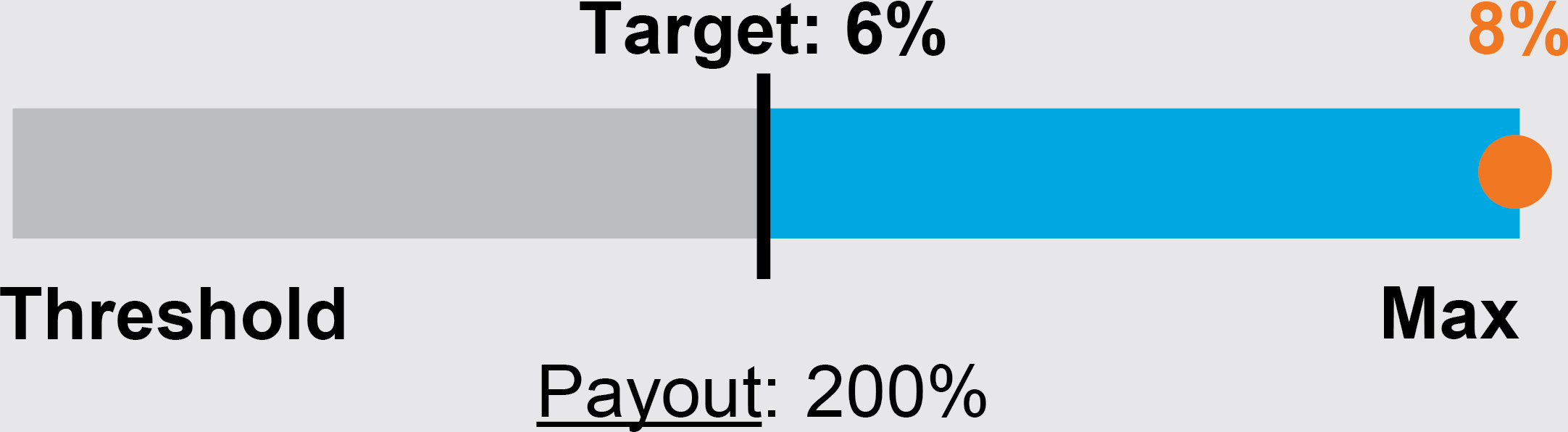

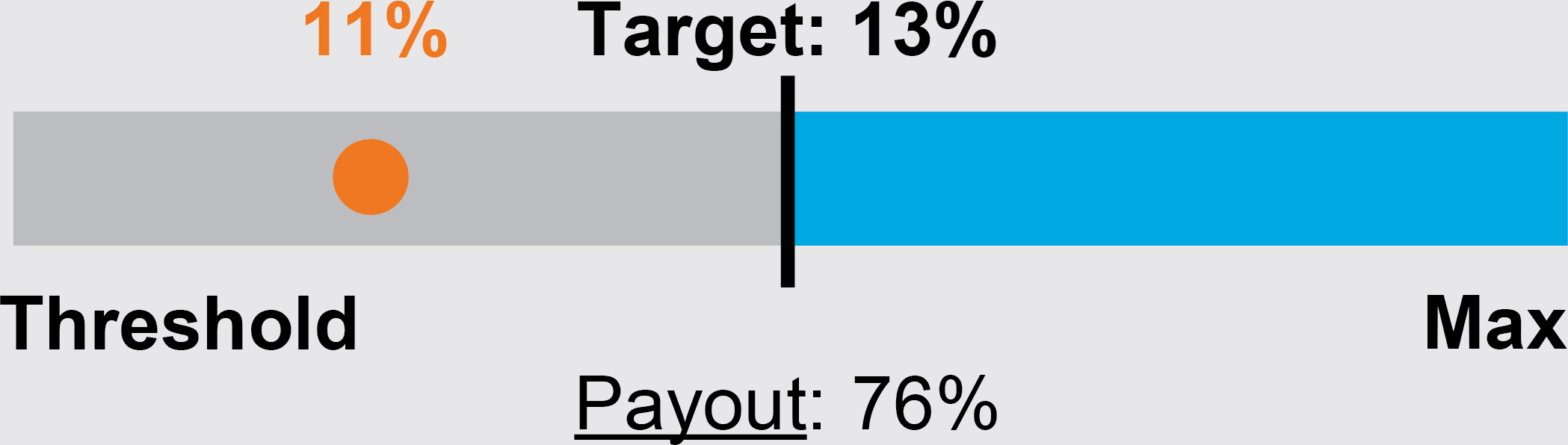

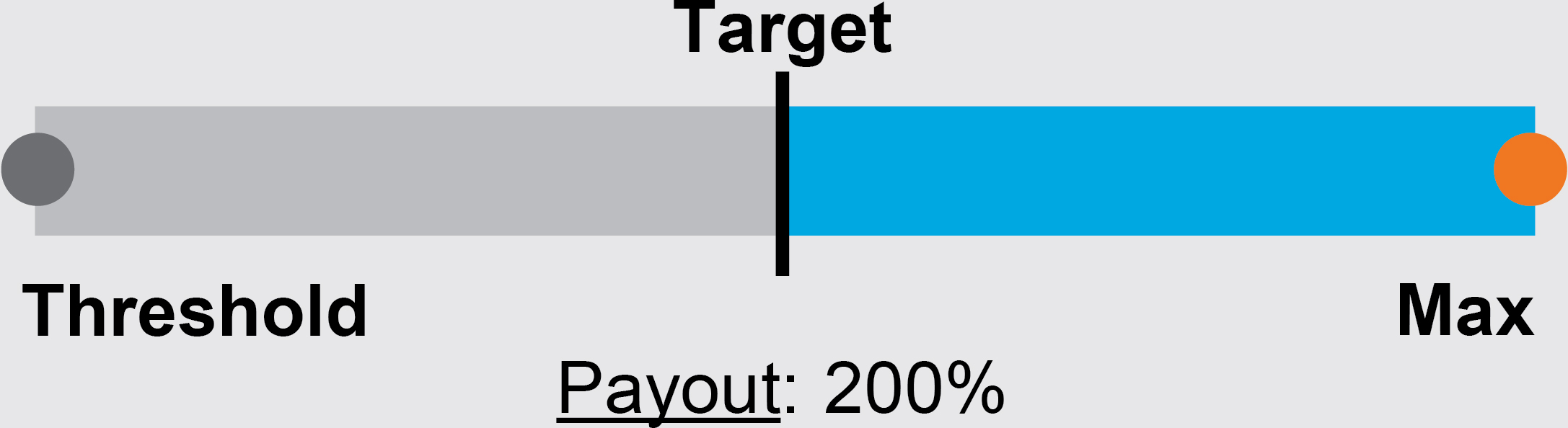

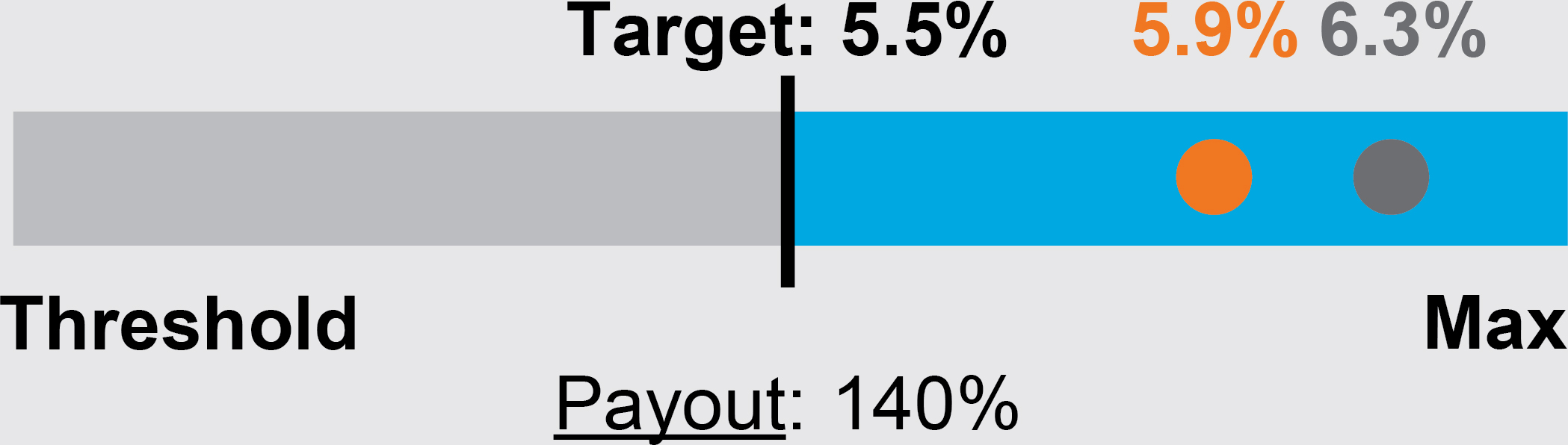

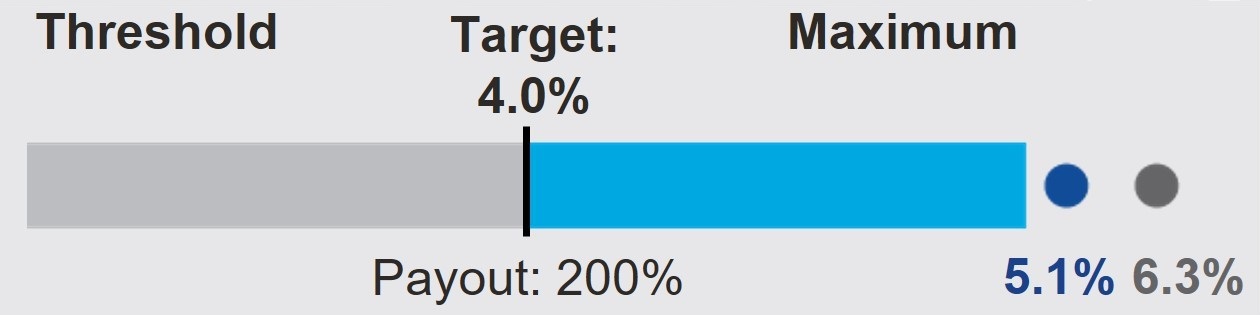

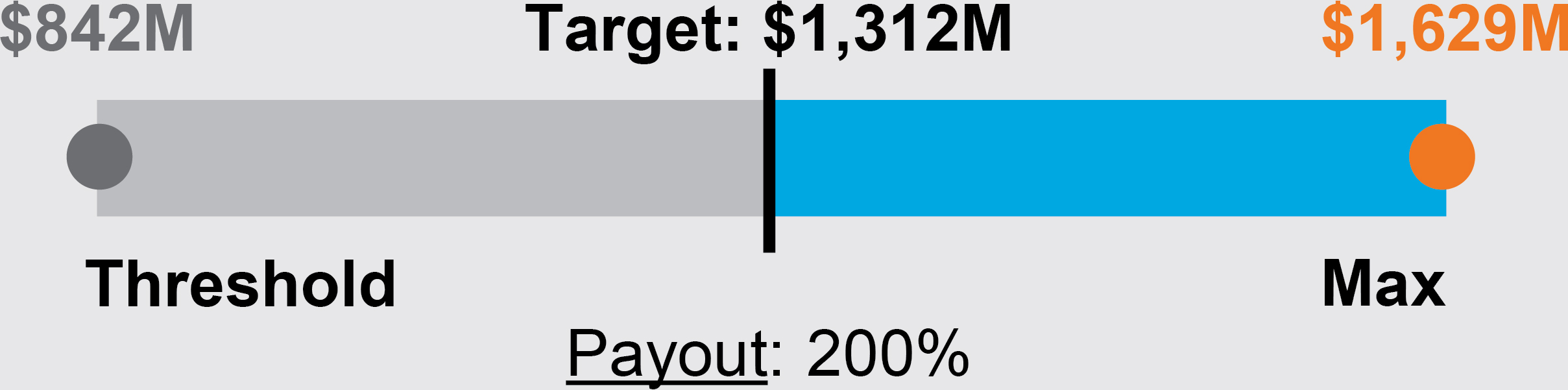

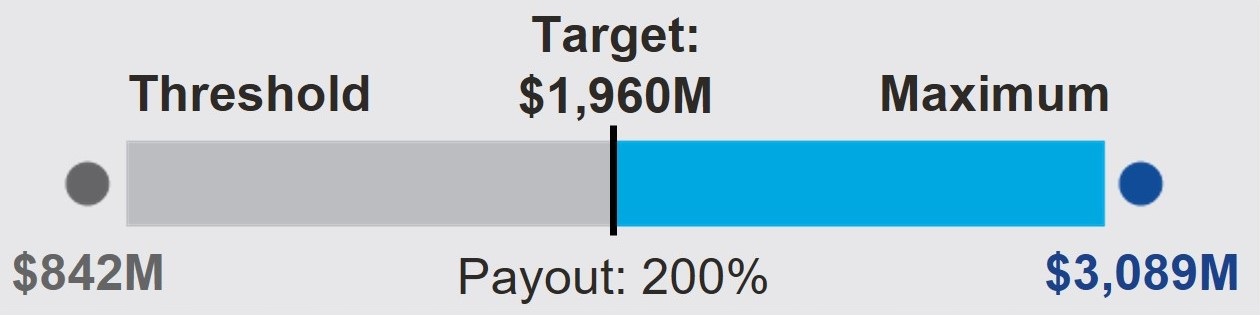

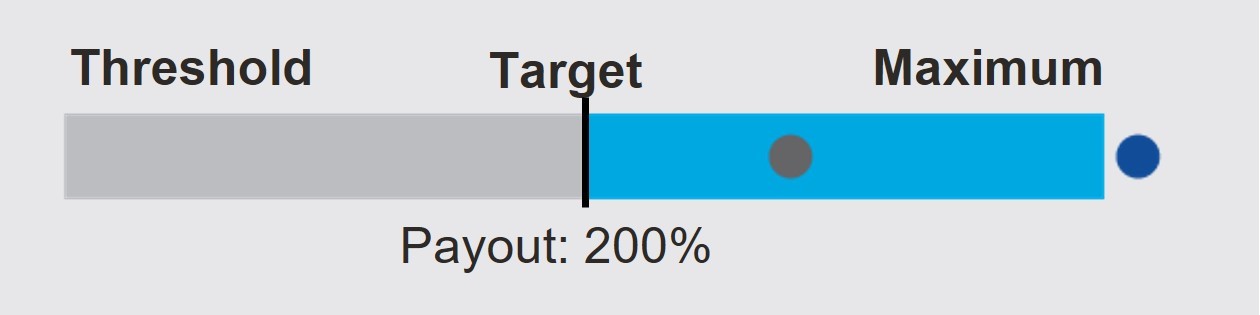

$407M 1,151MNet Income $1,629M 3,089MAdjusted EBITDA(2) (134%108% of Adjusted EBITDA target) | | +60.4%+12.6%

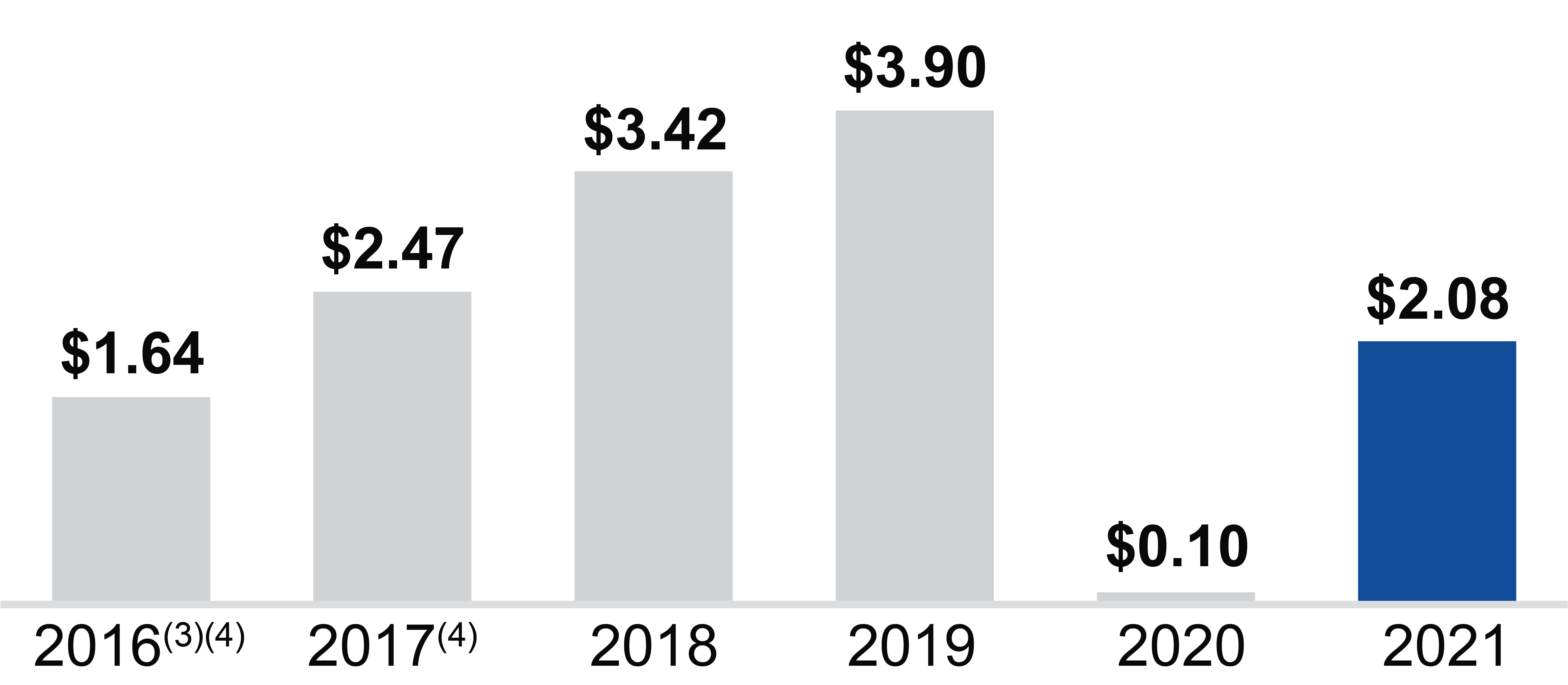

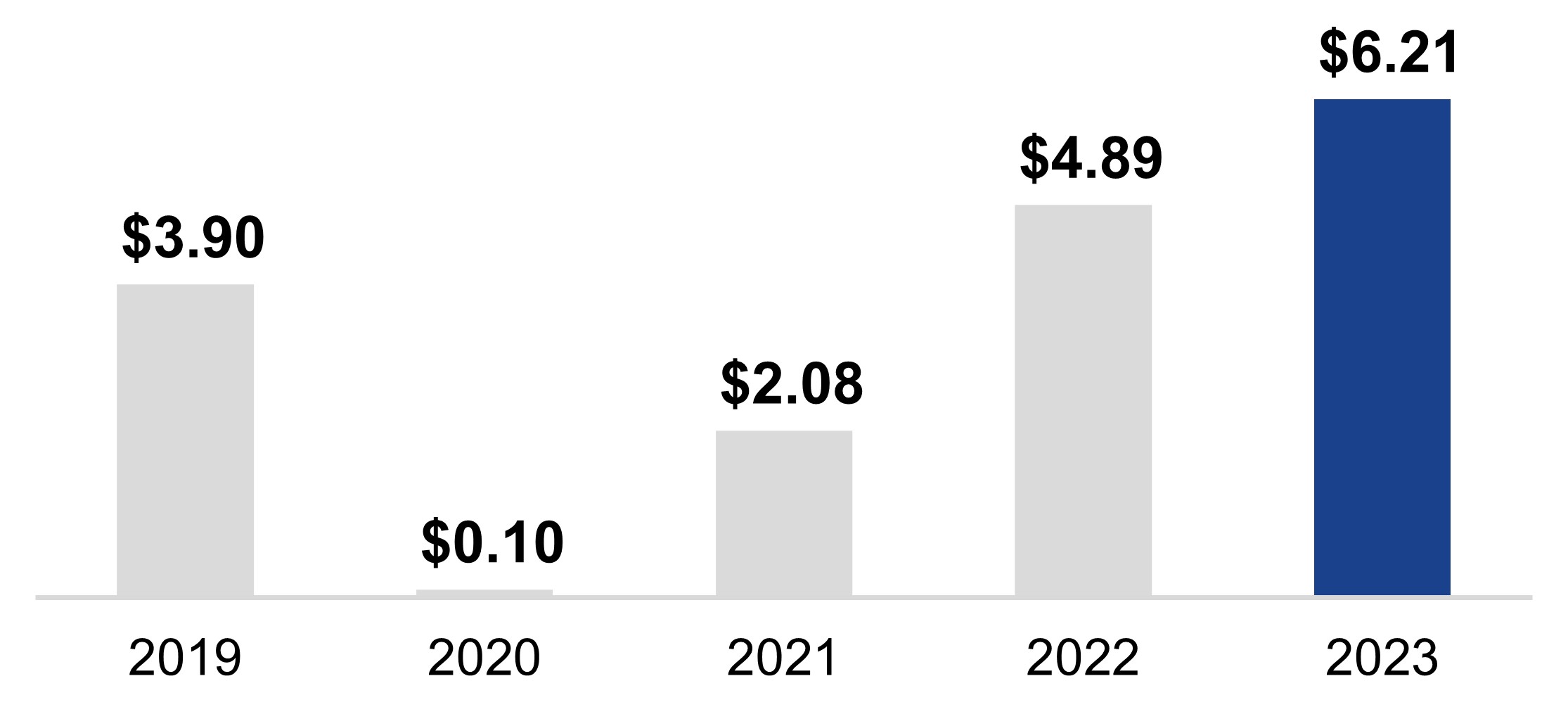

RevPAR(3) growth YOY(3) | | $1.46 4.33Diluted EPS(2) $2.08 6.21Adjusted Diluted EPS(2) |

| | | | |

| | | | |

| | | | |

408,000462,400

Pipeline Rooms | | Welcomed

414395 New Hotels

To surpass 6,700 hotels and7,500 properties with nearly 1M1.2M rooms across

122126 countries and territories

| | +5.6%+4.9%

Net Unit Growth YOY or 55,10053,100 net rooms

|

| | | | |

(1)Based on 5-year TSR measured from 12/31/16December 31, 2018 to 12/31/21;December 31, 2023; assumes reinvestment of dividends.

(2)Please seeRefer to Annex A for additional information, including the applicable definitions, and reconciliations of Adjusted EBITDA margin, Adjusted EBITDA and Adjusted Diluted EPS to financial measures derived in accordance with United States (“U.S.”) generally accepted accounting principles (“GAAP”).

(3)RevPAR, stands foror Revenue Per Available Room, and represents hotel room revenue divided by room nights available to guests for a given period. Itperiod and is basedpresented on a comparable hotelsand currency neutral basis as of December 31, 2021.2023. Refer to "Part II—Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Business and Financial Metrics Used by Management" of our Annual Report on our Form 10-K for the fiscal year ended December 31, 2023.

STOCKHOLDER ENGAGEMENT AND RESPONSIVENESS

| | | | | |

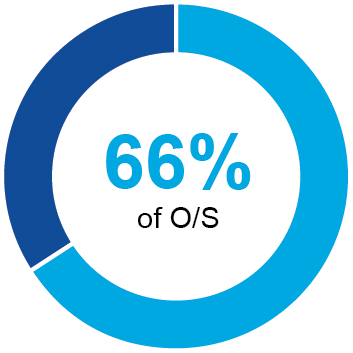

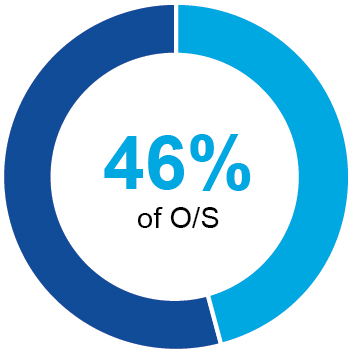

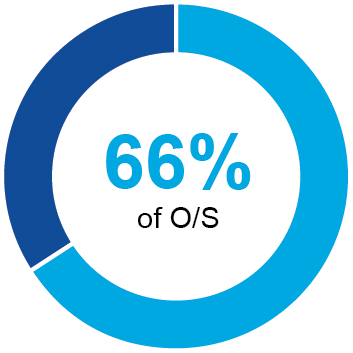

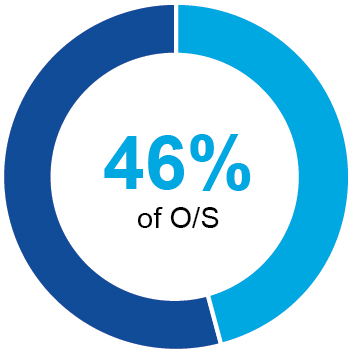

We value the perspective of our stockholders and believe that stockholder engagement leads to enhanced governance practices. This past year, we undertook a multi-phased program beginning with engagements leading up to our annual meeting and more extensive engagement in response to our 2021 Say-on-Pay proposal. Following the vote, we reached out to stockholders that held approximately 66% of outstanding shares of our common stock ("O/S") and engaged with stockholders that held approximately 46% of our O/S, including many who did not support our proposal. We also engaged with both of the leading proxy advisory firms. | Response to Stockholders:

•Implemented extensive engagement

•Addressed concerns regarding one-time 2020 compensation action

•Continue to evolve best-in-class ESG and Human Capital Management practices

|

|

The Board and management greatly valued the opportunity to hear from our stockholders. While the majority of stockholders we engaged with indicated they were broadly supportive of the overall structure of our executive compensation program, many who voted against our 2021 Say-on-Pay proposal said that opposition was driven by a one-time, non-recurring compensation action (the in-flight performance share unit ("PSU") LTI modifications on December 22, 2020, in light of the impact of the COVID-19 pandemic (the "pandemic")). |

|

| | | | | | | | | | | | | | |

Total Contacted | | Total Engaged | | Director Engaged |

| | | | |

| | | | |

The table below summarizes the common compensation themes that emerged from our engagement conversation and the Board’s responsiveness actions.

Primary Feedback

| | | | | |

What We Heard | How We Responded |

Disfavor of in-flight PSU modifications | We heard clear feedback that certain investors were not supportive of modifications made to unvested PSU awards in 2020. We committed that we do not intend to modify unvested PSUs again. For more information on the Compensation Committee’s response, please see page 29 under “Response to Primary Feedback” |

Other Feedback

| | | | | |

What We Heard | How We Responded |

Concern regarding the short performance period of the modified PSUs | We have returned to our historical practice of using a performance period that ends after three years for PSU performance metrics |

Questions about the performance period for PSU metrics that have a final-year performance measurement period | We have enhanced our disclosure around the performance requirements for these metrics. The Compensation Committee considers final-year measurement attributable to a three-year period because the target level was determined after modeling the performance that we would need to achieve over the entire three-year period in order to be positioned to attain final-year goals |

Preference for a greater portion of the annual cash incentive program to have objective metrics | After temporary modifications made to our program in 2020, we have returned to our normal program structure and have meaningfully enhanced our disclosure and transparency across the objective elements of the program. A significant portion of our annual cash incentive performance goals are conditioned on objective and quantitative targets and we have provided greater transparency into our underlying structure to ensure our investors have sufficient information to evaluate the rigor of the program |

Preference for increased disclosure of PSU targets | We have enhanced disclosure around the process for setting targets to provide transparency on the rigor of the PSU goal setting process. In addition, we have retroactively disclosed the targets for four out of the six 2019 PSU metrics (Adjusted EBITDA CAGR, FCF per share CAGR, NUG CAGR and Adjusted EBITDA). For the other two metrics (FCF per share and RevPAR Index Growth), we commit to disclosing PSU targets retroactively at such time that disclosures would not create competitive harm. For all metrics, we have further enhanced transparency by disclosing target levels relative to prior year actual achievement. Please see page 40 for additional information |

Desire for enhanced stock ownership requirements | While we already had robust stock ownership guidelines, we increased the CEO's stock ownership requirement from 5 to 6 times his base salary |

In our CD&A Executive Summary beginning on page 26, we highlighted our Company performance, executive compensation program and 2021 compensation decisions. In addition, our Board’s response to our 2021 Say-on-Pay vote is described in greater depth on page 29.We also heard stockholder feedback regarding our industry-leading Environmental, Social and Governance (“ESG”) practices, including our Human Capital Management (“HCM”), and incorporated perspectives from stockholders into our disclosures. We were pleased to hear that stockholders appreciated our dedication to ensure our current climate targets are ambitious, yet backed by a thoughtful and achievable roadmap, and our commitment to reducing our environmental footprint and sourcing renewable energy. Stockholders also recognized Hilton’s leadership on Diversity, Equity and Inclusion (“DE&I”) efforts and our HCM strategies to attract, develop and retain our Team Members. We will continue to incorporate stockholder feedback in our continued efforts to drive environmentally and socially sustainable behavior while promoting the wellbeing and prosperity of our Team Members and our communities.

EXECUTIVE COMPENSATION

For 2021,2023, the Compensation Committee maintained our historic underlying compensation program, given itsthe results of our 2022 Say-on-Pay vote and broad support by the majority of stockholders. We value the perspective of our stockholders with whom we engaged. and during the off-season reached out to stockholders representing over 55% of our outstanding common stock.

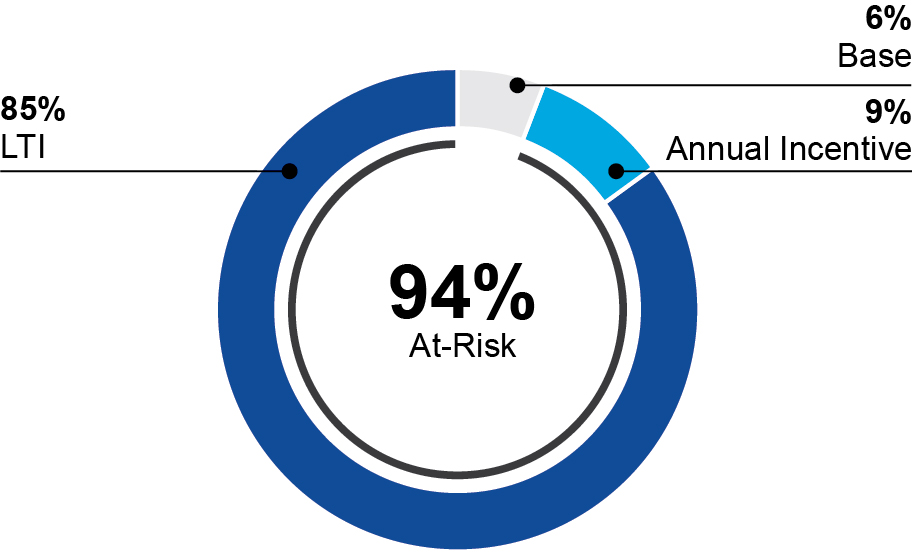

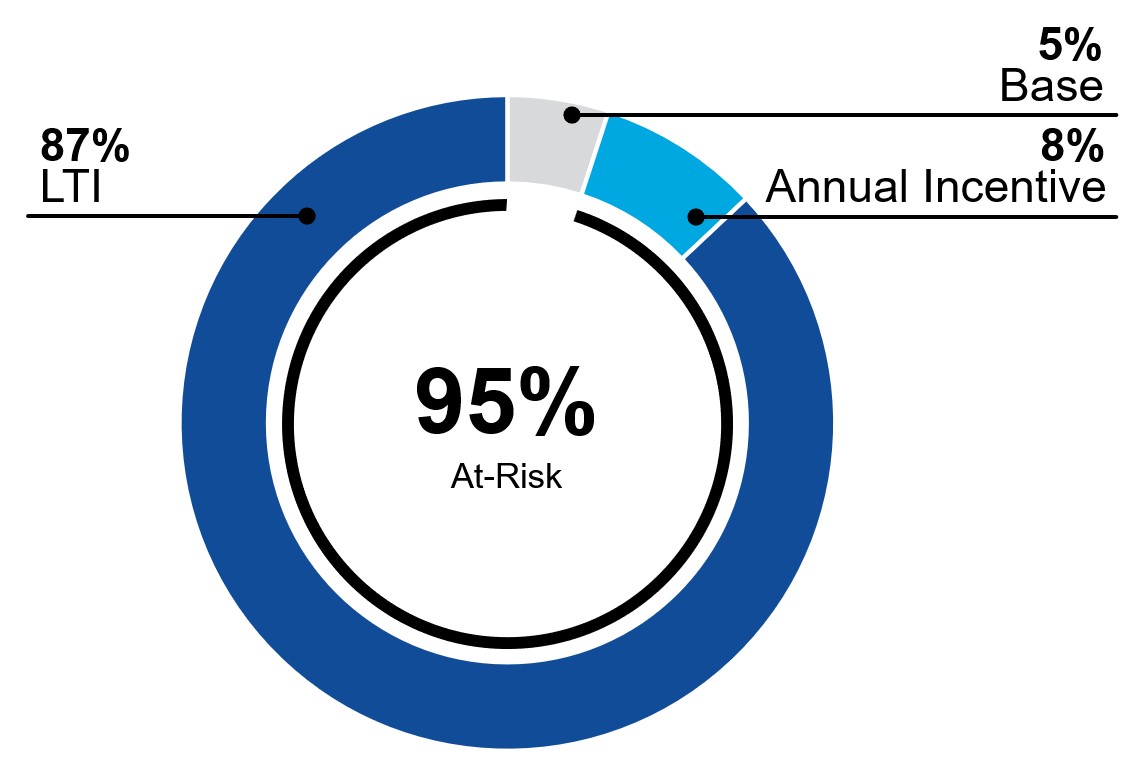

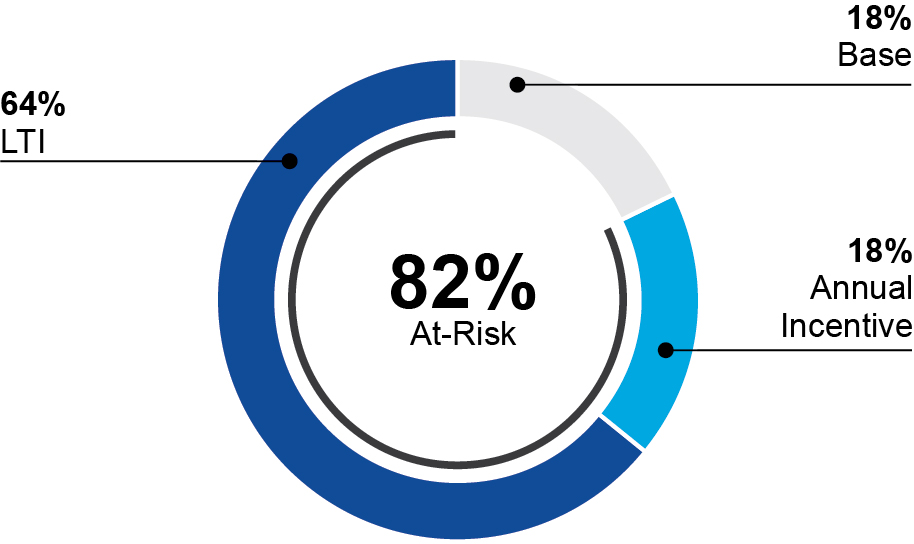

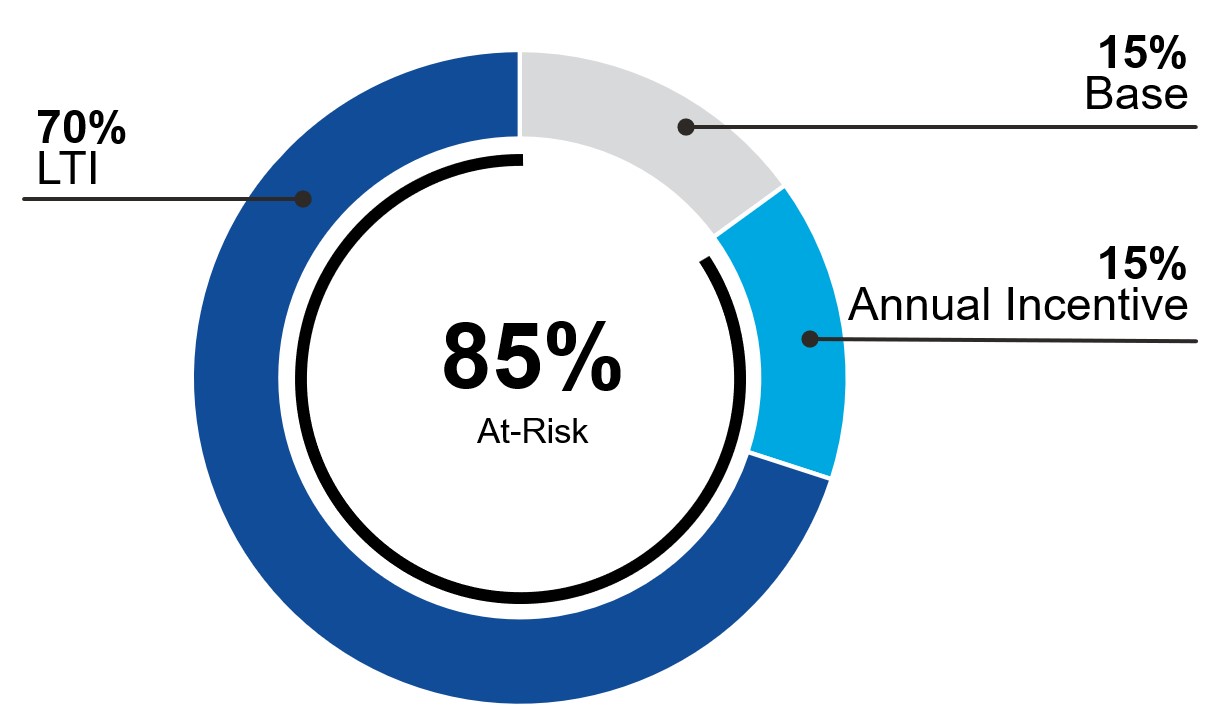

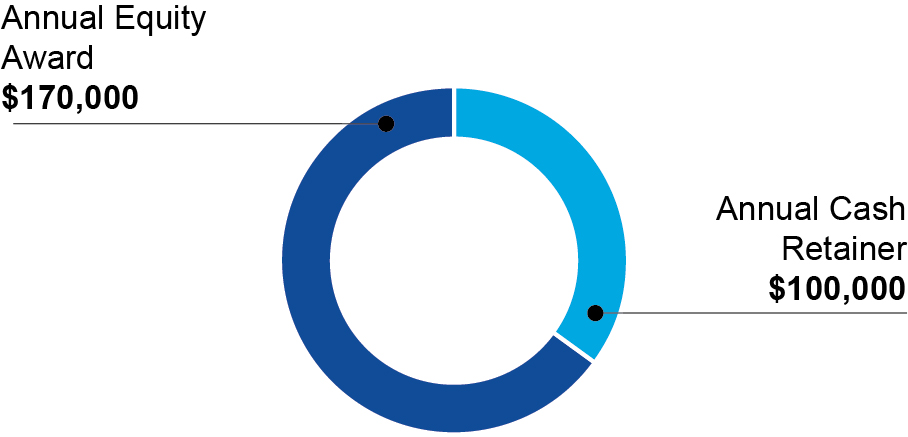

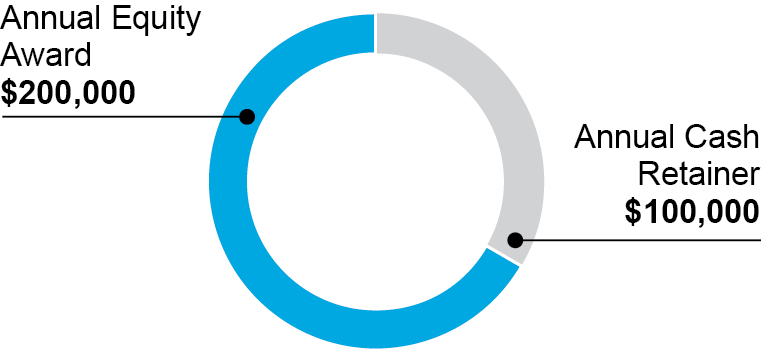

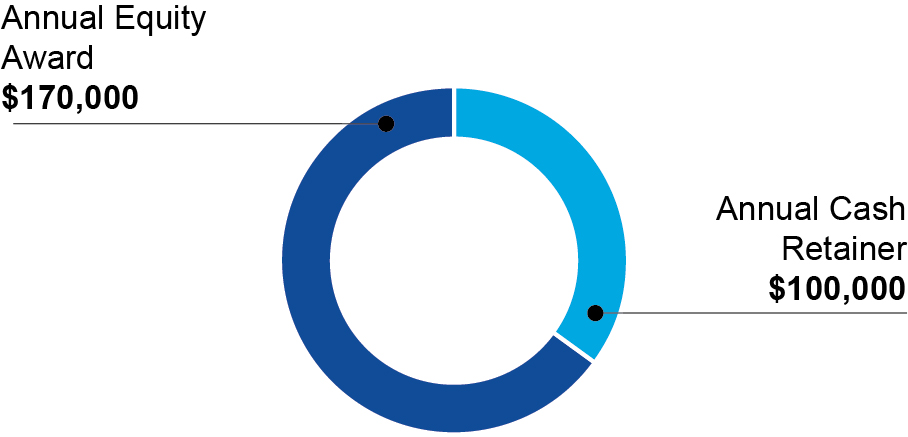

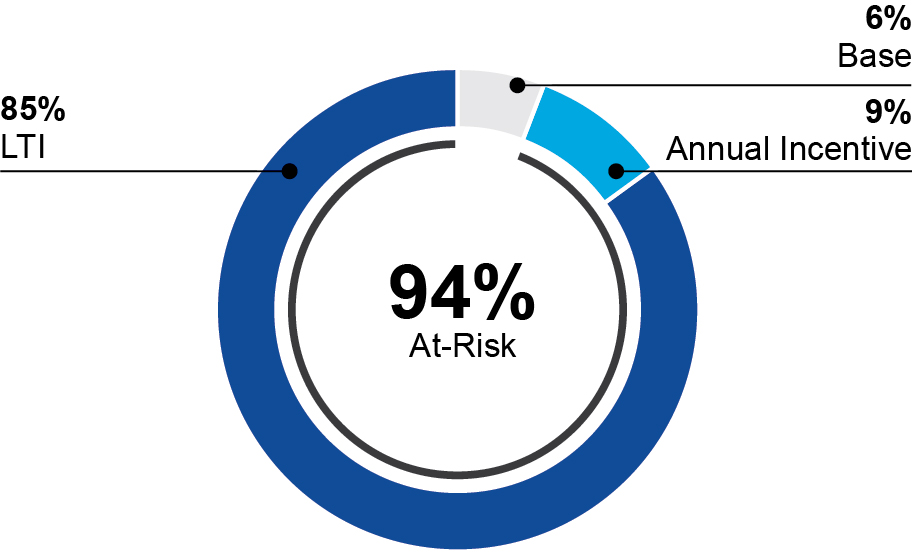

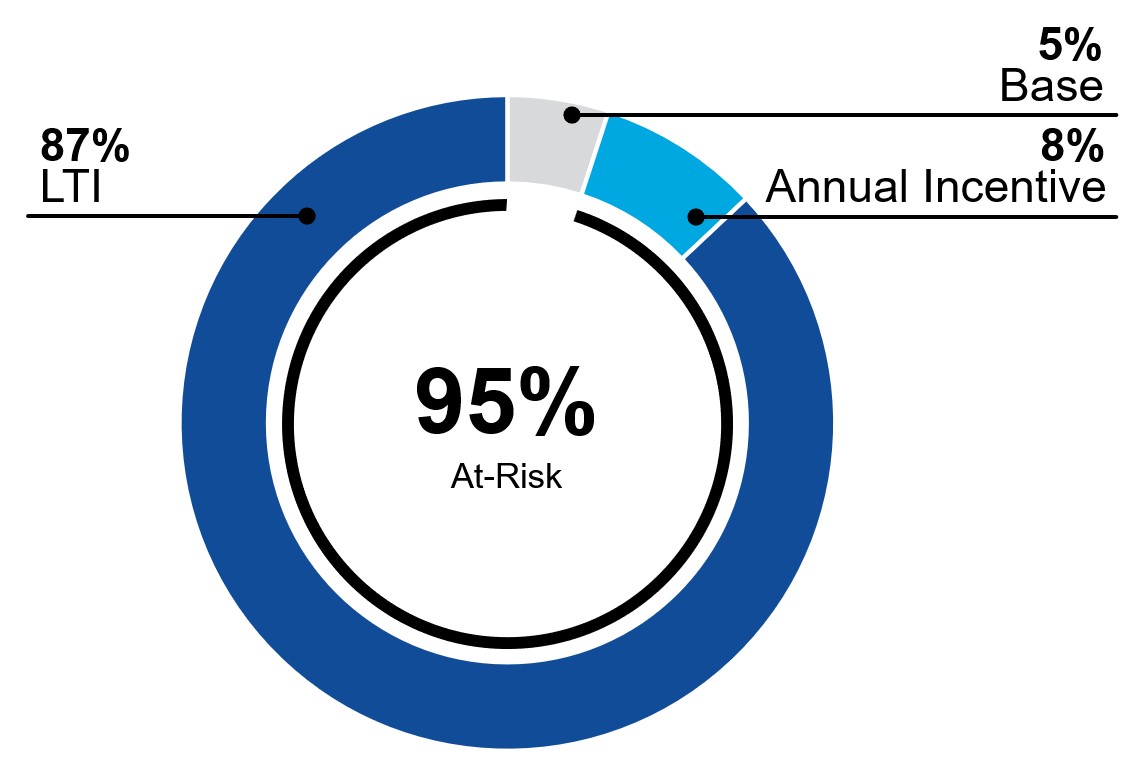

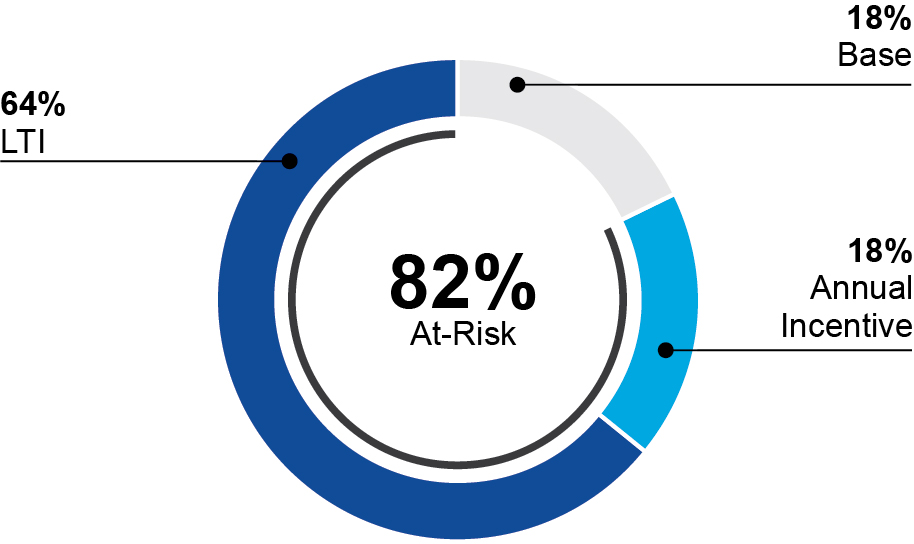

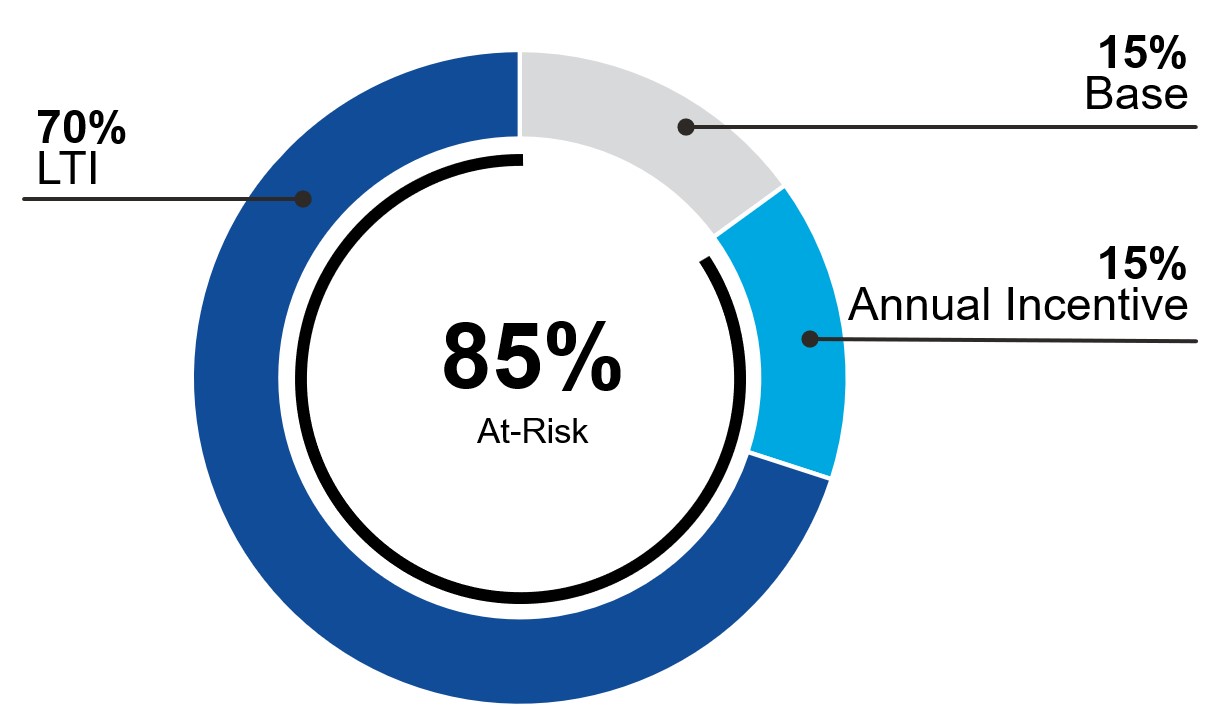

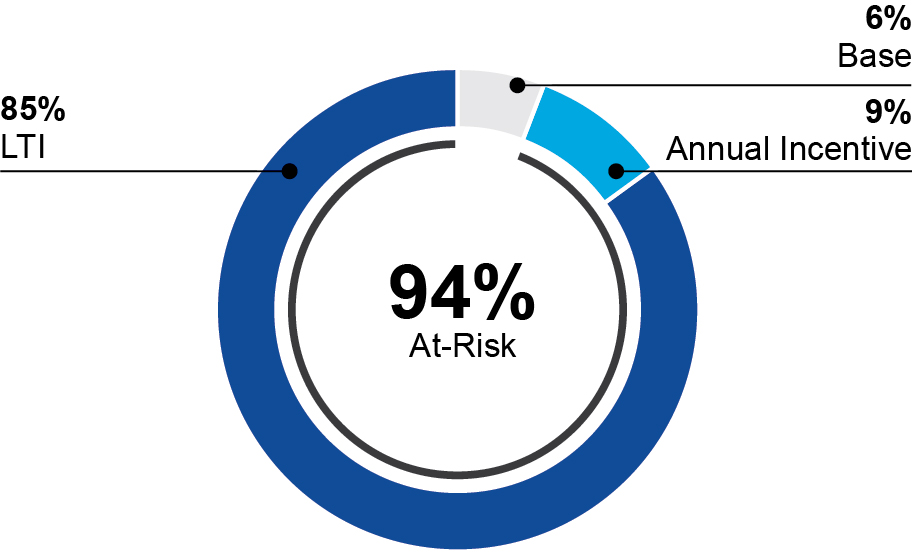

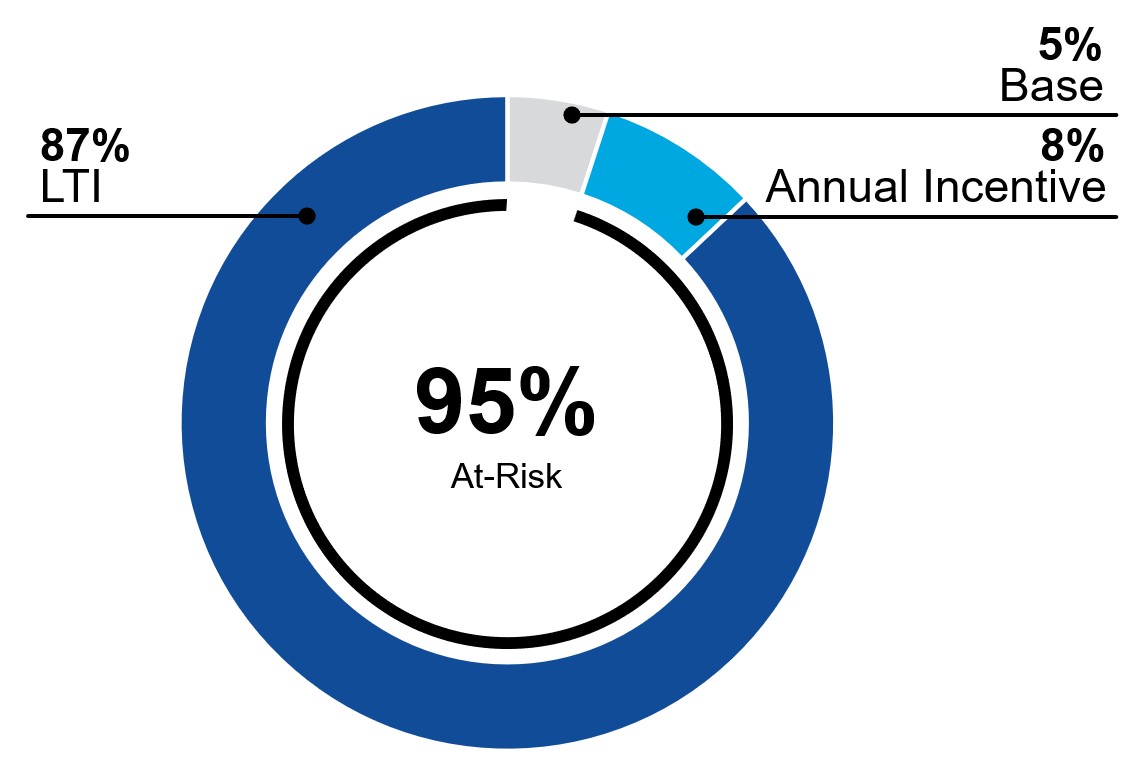

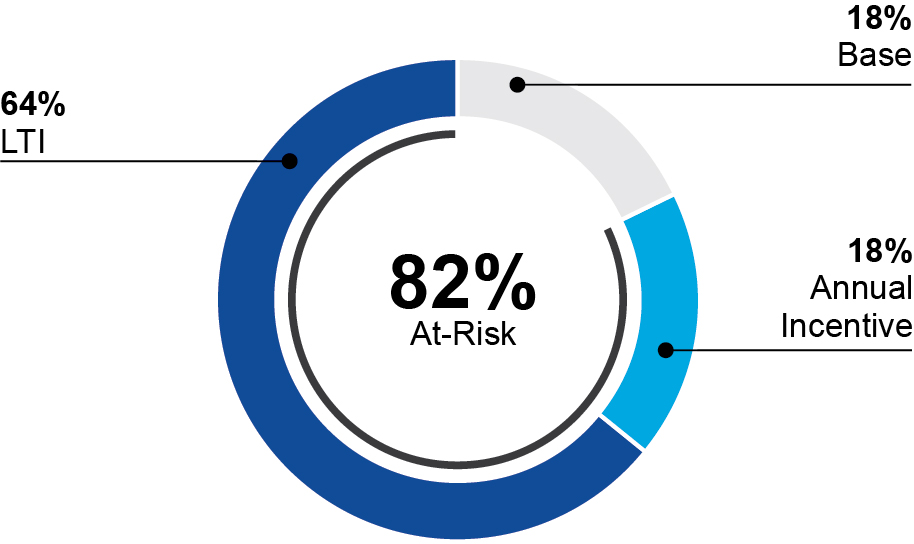

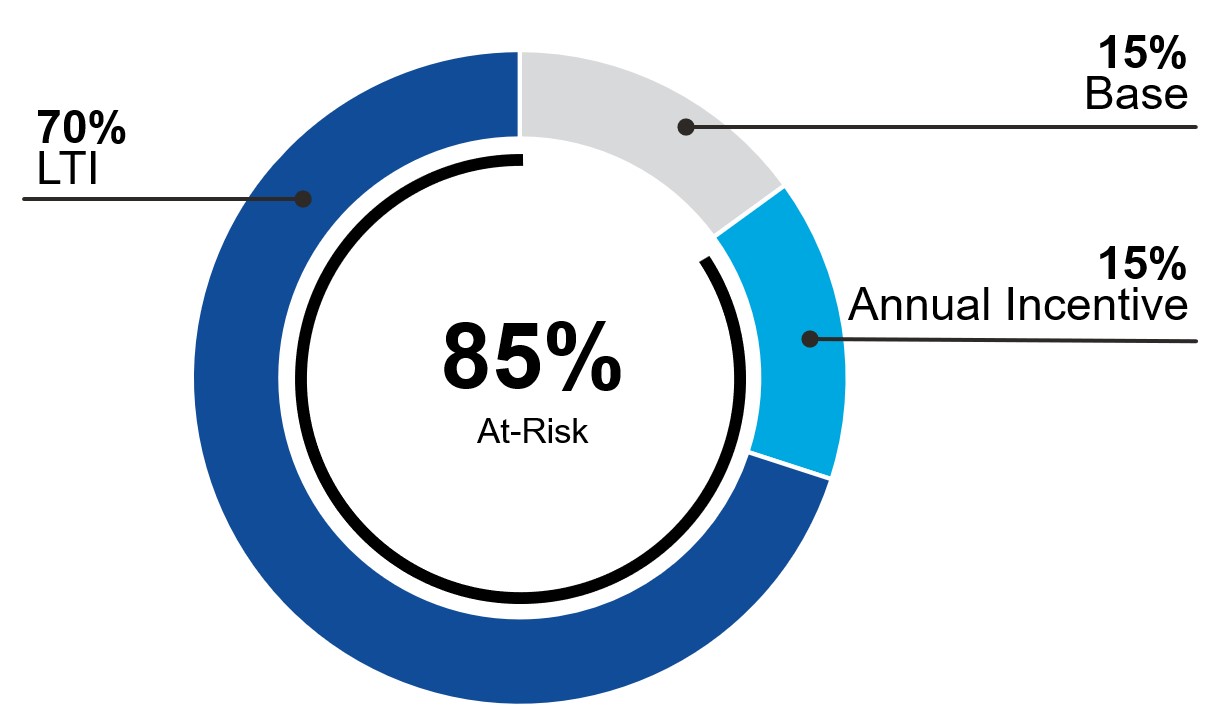

A significant portion of the compensation program for our Named Executive Officers (“NEOs”) is performance-based and at-risk, as illustrated below. The majority of target compensation is delivered in the form of equity that vests over multiple years, including 50% of our LTILong-Term Incentives ("LTI") comprising PSUsperformance share units ("PSUs") that vest at the end of a three-year period.period based on defined growth targets. For our CEO, 85%87% of total target compensation is delivered in equity.

| | | | | | | | |

20212023 CEO Target Compensation | | 20212023 Other NEO Target Compensation (Average) |

| | |

ESGENVIRONMENTAL, SOCIAL AND GOVERNANCE HIGHLIGHTS

ENVIRONMENTAL AND SOCIAL

Through another year of change and challenges, Hilton remainedis committed to preserving the destinations where we operate,driving responsible travel and tourism globally and generating positive environmental and social impact across our operations and communities through our Environmental, Social and Governance (“ESG”) strategy, Travel with Purpose. We continue to make progress towards our Travel with Purpose 2030 Goals, including: (i) environmental — aiming toward a net zero future with well-defined targets for watts (carbon and energy), water and waste; (ii) social — supporting ourand advancing careers, communities and implementing goodresponsible conduct; and (iii) governance practices. Some key highlights from 2021 include:

•Published— advancing and measuring our annualgoals with a focus on integrity and transparency through our company policies and reporting mechanisms, our external partnerships and our public affairs work. Our efforts are further described in our ESG Report (see our ESG website at www.esg.hilton.com)esg.hilton.com), aligned with best practice standards and frameworksframeworks.

ENVIRONMENTAL AND SOCIAL

We continued to make progress on our commitments and some key highlights from 2023 include:

•Submitted application toContinued progress toward achieving our revalidated near-term targets (1.5°C by 2030) with the Science-Based Targets initiative ("SBTi") with

•Introduced Hilton Cares, a program that will award $500,000 in scholarships and financial assistance to both Team Members and members of the community passionate about building and growing a career in hospitality

•Awarded over $4.4 million in Hilton Global Foundation grants to organizations supporting destination stewardship, climate action, career development and community resilience

•Supported more ambitious environmental targets to further reduce our greenhouse gas ("GHG") emissions, continuing to build on existing science-based targets

•Offset 100% of Scope 3 emissions from Hilton corporate air travelthan 3,400 individuals impacted by disaster and rental cars and launched Carbon Neutral Meetings program for customers to reduce and mitigate the carbon footprint of meetings and events

•Reduced single-use plastics by continuing to eliminate the use of miniature toiletry bottles at all hotels by the end of 2023 and by reducing waste from plastic key cardsextreme hardship through the expansion of Digital Key

•Announced new gender and ethnic diversity commitments, which we will disclose progress on annually, and shared detailed demographic data of ourHilton Team Member populationAssistance Fund, including Team Members(1) and their families, as well as individuals working at managed and franchised hotels who are not employed by Hilton

•Rolled out a newExpanded our Thrive at Hilton "Care for All" benefits and introduced a new suite of mental wellness platform with a dedicated counselor, the Thrive Global appwellbeing and an internal resource hubaddiction resources to support all Team Members, including at franchised hotels

•Awarded nearly $2 million in Hilton Effect Foundation grants, including $1.5 million

(1)Unless otherwise indicated, references to "Team Members" include individuals we employ at our 2021 Hilton Effect Annual Grant winners to organizations committed to restoringcorporate offices and our planetleased and communitiesmanaged hotels. It does not include individuals who work on-property at franchise hotels, which are independently owned and operated.

GOVERNANCE

Our commitment to strong governance practices that continued throughout 2021 isin 2023 as illustrated by the following:

•Commitment to a diverse director candidate pool

•Board-level oversight of cybersecurity and ESG matters

•Annual election of directors

•Lead independent director

•Single class of voting stock

•Majority voting standard for directors in uncontested elections

•Proxy access by-law

•No stockholder rights plan; and if our Board were ever to adopt a stockholder rights plan in the future without prior stockholder approval, we would either submit the plan to stockholders for ratification or cause the rights plan to expire within one year

Board Diversity

| | | | | | | | | | | |

| | | |

| Our policies require that candidate pools for the Board of Directors and CEO include gender and ethnic diversity |

|

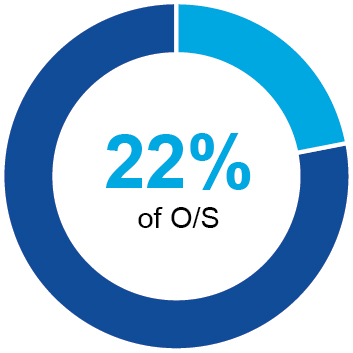

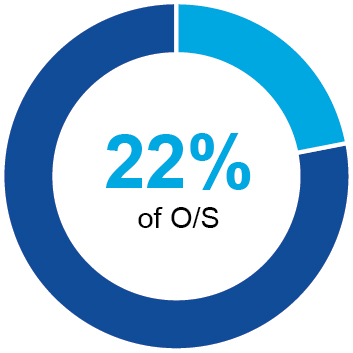

(1)Reflects the gender and ethnic diversity of our non-managementnon-employee directors; including the CEO, these figures are 44% gender diversity and 22% ethnic diversity.

VOTING ROADMAP

Our Board’s Recommendation | | | | | |

| Proposal No. 1: Election of All Director Nominees | FOR |

| Our Board of Directors believes that all of the director nominees listed in this proxy statement have the requisite qualifications to provide effective oversight of the Company’s business and management. | |

| | | | | |

| Proposal No. 2: Ratification of the Appointment of Ernst & Young LLP as independent registered public accounting firm | FOR |

Our Audit Committee and Board of Directors believe that the retention of Ernst & Young LLP as the Company's independent registered public accounting firm for 20222024 is in the best interest of the Company and its stockholders. | |

| | | | | |

| Proposal No. 3: Advisory Vote on Executive Compensation | FOR |

We are seeking a non-binding, advisory vote to approve, and our Board of Directors recommends the approval of, the 20212023 compensation paid to our named executive officers, which is described in the section of this proxy statement entitled “Executive Compensation.” | |

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

Our Board of Directors (the “Board” or “Board of Directors”) has considered and nominated the following nominees for a one-year term expiring at the 20232025 Annual Meeting of Stockholders or until their successor is duly elected and qualified: Christopher J. Nassetta; Jonathan D. Gray; Charlene T. Begley; Chris Carr; Melanie L. Healey; Raymond E. Mabus, Jr.; Judith A. McHale; Elizabeth A. Smith and Douglas M. Steenland. Action will be taken at the Annual Meeting for the election of these nominees.

Unless otherwise instructed, the persons named in the form of proxy card (the “proxyholders”) included with this proxy statement, as filed with the Securities and Exchange Commission (“SEC”), intend to vote the proxies held by them for the election of the director nominees. If any of these nominees ceases to be a candidate for election by the time of the Annual Meeting, such proxies may be voted by the proxyholders in accordance with the recommendation of the Board. Except where the context requires otherwise, references to the “Company,” “Hilton,” “we,” “us” and “our” refer to Hilton Worldwide Holdings Inc.

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS IN 20222024

The following information describes the offices held, other business directorships and the term of each director nominee as of February 28, 2022.2024. Beneficial ownership of equity securities of the director nominees is shown under “Ownership of Securities” below.on page 54. | | | | | |

| Christopher J. Nassetta |

| |

| Christopher J. Nassetta, 59,61, joined Hilton as President and Chief Executive Officer in December 2007 and has served as a director of Hilton since that time. Previously, he was President and Chief Executive Officer of Host Hotels and Resorts, Inc., a position he held from May 2000 until October 2007. He joined Host in 1995 as Executive Vice President and was elected Chief Operating Officer in 1997. Before joining Host, Mr. Nassetta co-founded Bailey Capital Corporation, a real estate investment and advisory firm, in 1991. Prior to this, he spent seven years at The Oliver Carr Company, a commercial real estate company, where he ultimately served as Chief Development Officer. Mr. Nassetta is an Advisory Board member for the McIntire School of Commerce at the University of Virginia. He is also a member of the board of directors, nominating and corporate governance committee and compensation committee of CoStar Group, Inc. He is alsoChair of the U.S. Travel Association, a member and a past Chairman of The Real Estate Roundtable, former Chairman and Executive Committee member of the World Travel & Tourism Council, a member of the Economic Club of Washington, a member of the Federal City Council, and has served in various positions at the Arlington Free Clinic. Mr. Nassetta graduated from the McIntire School of Commerce at the University of Virginia with a degree in Finance. Qualifications, Attributes, Skills and Experience: extensive experience as an executive in the hospitality industry, extensive financial background and experience with real estate investments; his role as our President and Chief Executive Officer brings management perspective to board deliberations and provides valuable information about the status of our day-to-day operations. |

| | | | | |

| Jonathan D. Gray |

| |

| Jonathan D. Gray, 52,54, is Chairman of our Board and has served as a director of Hilton since 2007. Mr. Gray is President and Chief Operating Officer of Blackstone Inc. (“Blackstone”), and has served as a member of the board of directors of Blackstone since February 2012. He previously served as global head of real estate for Blackstone from January 2012 through February 2018. He also sits on Blackstone’s management committee. Mr. Gray served as a senior managing director and co-head of real estate from January 2005 to December 2011. Mr. Gray received a B.S. in Economics from the Wharton School, as well as a B.A. in English from the College of Arts and Sciences at the University of Pennsylvania, where he graduated magna cum laude and was elected to Phi Beta Kappa. He is a member of the board of directors of Corebridge Financial. He also serves on the board of Harlem Village Academies. He previously served as a board member of Nevada Property 1 LLC (The Cosmopolitan of Las Vegas), Invitation Homes Inc., Brixmor Property Group and La Quinta Holdings Inc. Mr. Gray and his wife, Mindy, have established the Basser Research Center at the University of Pennsylvania School of Medicine, which focuses on the prevention and treatment of certain genetically caused breast and ovarian cancers. They also established NYC Kids RISE in partnership with the City of New York to accelerate college savings for low-income children. Qualifications, Attributes, Skills and Experience: substantial experience with real estate investing and extensive financial background, including in-depth knowledge of the real estate and hospitality industries. |

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

| | | | | |

| Charlene T. Begley |

| |

| Charlene T. Begley, 55,57, has served as a director of Hilton since 2017. Ms. Begley served in various capacities at General Electric Company from 1988 through 2013. Most recently, she served in a dual role as Senior Vice President and Chief Information Officer, as well as the President and Chief Executive Officer of GE’s Home and Business Solutions business from January 2010 through December 2012. Ms. Begley served as President and Chief Executive Officer of GE Enterprise Solutions from August 2007 through December 2009. During her career at GE, she served as President and Chief Executive Officer of GE Plastics and GE Transportation, led GE’s Corporate Audit staff and served as the Chief Financial Officer for GE Transportation and GE Plastics Europe and India. Ms. Begley currently serves as a director and member of the audit and risk committee and chair of the nominating & ESG committee of Nasdaq, Inc. and a director and chair of the audit committee of SentinelOne, Inc., and previously served as a director and member of the audit and nominating committees of Red Hat, Inc. Ms. Begley also previously served as a director and member of the audit and nominating committees of WPP plc. Qualifications, Attributes, Skills and Experience: extensive business and management expertise, including leading divisions of a global enterprise, significant experience in technology, finance and information security, and service as a director of several public companies. |

| | | | | |

| Chris Carr |

| Chris Carr

| |

| Chris Carr, 58,60, has served as a director of Hilton since 2020. Mr. Carr ispreviously served as the Chief Operating Officer of Sweetgreen, Inc. from 2020 to 2023. From 2006 to 2019, he served in a variety of retail and supply chain senior executive roles at Starbucks, most recently as the Executive Vice President ("EVP"), Chief Procurement Officer, where he was responsible for enhancing the enterprise-wide, global strategic sourcing and supplier relationship capabilities.relationships. Mr. Carr served as Starbucks’ EVP, Americas Licensed Stores, where he was responsible forleading the strategic planning, operations, market planningdevelopment and sales for 6,500 licensed retail stores. He also led their U.S. retail business as the EVP, U.S. Retail Stores, where he was accountable for the brand and omni-channel customer experience at approximately 13,000 U.S. company-operated and licensed retail stores. Prior to Starbucks, Mr. Carr spent 18 years in multiple executive leadership roles with ExxonMobil developing, leading and implementing retail operational strategies for its Global Fuels Marketing downstream businesses. Mr. Carr holds a B.S. in Business Administration from the University of San Diego, and an M.B.A. from the New York Institute of Technology. He serves on the board of directors for Recreational Equipment Inc. (REI)("REI") and Bridgestone Americas and he is on the board of trustees for Howard University and the University of San Diego. Qualifications, Attributes, Skills and Experience: extensive business and management expertise, including leadership roles in a global enterprise, significant experience in supply chain, strategy, brands, consumer marketing and international operations. |

| | | | | |

| Melanie L. Healey |

| |

| Melanie L. Healey, 60,62, has served as a director of Hilton since 2017. Ms. Healey served as Group President of The Procter & Gamble Company ("Procter & Gamble") from 2007 to 2015. During her tenure at Procter & Gamble, one of the leading providers of branded consumer packaged goods, Ms. Healey held several leadership roles, including Group President and advisor to the Chairman and CEO, Group President, North America and Group President, Global Health, Feminine and Adult Care Sector. Ms. Healey has more than 30 years of strategic, branding and operating experience from leading consumer goods companies including Procter & Gamble, Johnson & Johnson and S.C. Johnson & Sons. Ms. Healey also serves as a director of PPG Industries, Inc., Verizon Communications Inc. and Kenvue Inc. She has informed Verizon Communications Inc. that she will not stand for re-election when her term expires at Verizon's 2024 annual meeting of shareholders. She previously served as a director of Target Corporation. Qualifications, Attributes, Skills and Experience: extensive business and management experience, including leadership roles in a global enterprise, significant experience in strategy, brands, consumer marketing and international operations and service as a director of several public companies. |

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

| | | | | |

| Raymond E. Mabus, Jr. |

| |

| Raymond E. Mabus, Jr., 73,75, has served as a director of Hilton since 2017 and2017. Mr. Mabus brings significant public sector experience to the Hilton board, having served as the 75th United States Secretary of the Navy from 2009 to 2017. He was the United States Ambassador to the Kingdom of Saudi Arabia from 1994 to 1996, the 60th Governor of Mississippi from 1988 to 1992 and Auditor of the State of Mississippi from 1984 to 1988. He is currently CEO of The Mabus Group, a consulting company, and chairvice-chair of InStride, a public benefit company. Mr. Mabus currently serves as chair of Kadem Sustainable Impact Corp.,Virgin Galactic Holdings, a public company, and is on the board of Amentum Services, Inc., a private company, and on the non-profit boards of World Central Kitchen and the Environmental Defense Fund. He previously served as a director of Dana Incorporated, until April 2022as chair of Kadem Sustainable Impact Corp. and previously served as Chairman and Chief Executive Officer of Foamex International. Qualifications, Attributes, Skills and Experience: extensive international experience, including as U.S. ambassador to the Kingdom of Saudi Arabia, public policy and government relations experience, including as U.S. Secretary of the Navy and governorGovernor of the State of Mississippi, and public company executive and board experience. |

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

| | | | | |

| Judith A. McHale |

| |

| Judith A. McHale, 75,77, has served as a director of Hilton since 2013. Ms. McHale has served as President and Chief Executive Officer of Cane Investments, LLC since August 2011. From May 2009 to July 2011, Ms. McHale served as Under Secretary of State for Public Diplomacy and Public Affairs for the U.S. Department of State. From 2006 to March 2009, Ms. McHale served as a Managing Partner in the formation of GEF/ Africa Growth Fund. Prior to that, Ms. McHale served as the President and Chief Executive Officer of Discovery Communications. Ms. McHale currently serves on the board of directors of Ralph Lauren Corporation and ViacomCBS Inc.Paramount and previously served on the board of directors of Ralph Lauren Corporation and Sea World Entertainment, Inc. Ms. McHale graduated from the University of Nottingham in England and Fordham University School of Law. Qualifications, Attributes, Skills and Experience: extensive business and management expertise, including experience as a chief executive officer and director of several public companies, as well as prior service as a high-ranking official in the U.S. Department of State. |

| | | | | |

| Elizabeth A. Smith |

| |

| Elizabeth A. Smith, 58,60, has served as a director of Hilton since 2013. Ms. Smith has beenis Executive Chair of Revlon. She was a member of the board of directors of Bloomin’ Brands, Inc. sincefrom November 2009 to April 2023 and previously served as its Executive Chairman of the Board from April 2019 to February 2020, its Chairman of the Board from January 2012 to April 2019, and its Chief Executive Officer from November 2009 to April 2019. From September 2007 to October 2009, Ms. Smith was President of Avon Products, Inc., a global beauty products company, and was responsible for its worldwide product-to-market processes, infrastructure and systems, including Global Brand Marketing, Global Sales, Global Supply Chain and Global Information Technology. In January 2005, Ms. Smith joined Avon Products, Inc. as President, Global Brand, and was given the additional role of leading Avon North America in August 2005. From September 1990 to November 2004, Ms. Smith worked in various capacities at Kraft Foods Inc. Ms. Smith currently serves on the board of directors of Brown-Forman Corporation and the U.S. Fund for UNICEF andUNICEF. Ms. Smith previously served as chair of the Atlanta Federal Reserve Board. Ms. Smith servedBoard, as a member of the board of directors and audit committee of Staples, Inc. and as a member of the board of directors of The Gap, Inc. Ms. Smith holds a bachelor’s degree, Phi Beta Kappa, from the University of Virginia and an M.B.A. from the Stanford Graduate School of Business. Qualifications, Attributes, Skills and Experience: experience in strategy, brands, marketing and sales, as well as corporate finance and financial reporting developed in her executive level roles where her responsibilities have included direct financial oversight of multinational companies with multiple business units. |

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

| | | | | |

| Douglas M. Steenland |

| |

| Douglas M. Steenland, 70,72, has served as a director of Hilton since 2009. Mr. Steenland worked for Northwest Airlines Corporation from September 1991 to October 2008, serving as Chief Executive Officer from April 2004 to October 2008 and as President from February 2001 to April 2004. During his tenure at Northwest Airlines, he also served as Executive Vice President, Chief Corporate Officer and Senior Vice President and General Counsel. Mr. Steenland retired from Northwest Airlines upon its merger with Delta Air Lines, Inc. Prior to his time at Northwest Airlines, Mr. Steenland was a senior partner at a Washington, D.C. law firm that is now part of DLA Piper. Mr. Steenland is currently lead director of the American International Group, Inc. board of directors and a member of the board of directors of American Airlines Group Inc. He also serves on the board of the London Stock Exchange Group. Mr. Steenland previously served as a director of American International Group, the London Stock Exchange, Performance Food Group Company, Travelport Worldwide Limited, Digital River, Inc. and Chrysler Group LLC. Mr. Steenland received a B.A. from Calvin College and is a graduate fromof The George Washington University Law School. Qualifications, Attributes, Skills and Experience: experience in managing large, complex, international institutions generally and experience as a member of global public company boards and an executive in the travel and hospitality industries in particular. |

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF

EACH OF THE DIRECTOR NOMINEES NAMED ABOVE.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

BOARD SKILLS AND DEMOGRAPHICS MATRIX

The Nominating and ESG Committee and the full Board believe that the Board members should possess a complementary mix of diverse skills, attributes and experiences to serve the Company and its stockholders. The matrix below highlights the specific experience, qualifications, attributes and skills for each director that the Board considers important in determining whether each nominee should serve on the Board in light of the Company’s business and strategy. The absence of a mark for a particular skill does not mean that director does not possess that particular skill or qualification or is unable to contribute to the decision-making process in that area. The demographic information presented below is based on voluntary self-identification by each nominee.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Experience / Qualification / Skill | Begley | Carr | Gray | Healey | Mabus | McHale | Nassetta | Smith | Steenland |

Hospitality / Travel Industry experience represents our core business | | | X | | | | X | | X |

Accounting / CFO / Auditing experience enables understanding of our financial reporting and internal controls | X | | | | | | X | X | X |

Risk / Crisis Management experience reflects the ability to respond to the inevitable challenges that come with operating a dynamic global business | X | | X | X | X | | X | X | X |

Capital Markets / Financing experience is important to maintaining a healthy balance sheet no matter the economic environment | | | X | | | | X | X | X |

Brands / Marketing experience supports the growth of our business around the world | | X | | X | | X | X | X | |

International experience supports our scope and plans for future development as well as the challenges of operating a global enterprise | X | X | X | X | X | X | X | X | X |

Technology / Cybersecurity experience supports our innovation as we strive to serve our guests in new and convenient ways | X | | | | X | | | | |

Senior Executive Leadership experience running large organizations provides practical expertise and understanding of corporate strategy, financial oversight, risk management and talent management | X | X | X | X | X | X | X | X | X |

ESG insight will be critical to the future success of Hilton as we seek to do well by doing good | | X | | | X | | X | X | |

Government / Public Policy experience provides important perspective as Hilton navigates a challenging political and increasingly regulated global environment | | | | | X | X | | | |

Public Company Board experience provides an understanding of corporate governance, stockholder relations and board oversight of management | X | X | X | X | X | X | X | X | X |

Legal experience provides appropriate perspective on evaluating risk, regulations and obligations | | | | | | X | | | X |

| Demographics | | | | | | | | | |

| African American or Black | | X | | | | | | | |

| Alaskan Native or Native American | | | | | | | | | |

| Asian | | | | | | | | | |

| Hispanic or Latinx | | | | X | | | | | |

| Native Hawaiian or Pacific Islander | | | | | | | | | |

| White | X | | X | X | X | X | X | X | X |

| Two or More Races or Ethnicities | | | | | | | | | |

| Member of LGBTQ+ Community | | | | | | | | | |

| Gender | | | | | | | | | |

| Female | X | | | X | | X | | X | |

| Male | | X | X | | X | | X | | X |

| Non-Binary | | | | | | | | | |

| Years on Hilton Board | 7 | 4 | 16 | 6 | 6 | 10 | 16 | 10 | 14 |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

As oneHilton strives to create long-term value for all of our stakeholders and strengthen the world's largest hotel companies, we recognize Hilton has a responsibility to protectresilience of our communities and the environment so the destinations we serve can remain vibrant and resilient for future generations of travelers.

ESG HIGHLIGHTS

Through Travel with Purpose, our ESG strategy to drivebusiness while also advancing responsible travel and tourism globally we seekthrough our ESG strategy, Travel with Purpose. As one of the world’s largest hospitality companies, Hilton recognizes its responsibility to create positive environmental and social impact across our operations, supply chain and communities. While environmentalcommunities to ensure our hotel properties and social impact has long been a prioritysurrounding communities remain vibrant and resilient for Hilton, in 2018, we setgenerations of travelers to come.

ESG HIGHLIGHTS

We continue to make progress towards our ambitious Travel with Purpose 2030 Goals, to hold ourselves accountableincluding: (i) environmental — aiming toward a net zero future with well-defined targets for the environmentalwatts (carbon and energy), water and waste; (ii) social progress we aim to achieve in— supporting and advancing careers, communities and responsible conduct; and (iii) governance — advancing and measuring our business. goals with a focus on integrity and transparency through our company policies and reporting mechanisms, our external partnerships and our public affairs work.

Our 2030 Goals are underpinned by targets that closely align with the United Nations'global Sustainable Development Goals (“SDGs”("SDGs"). To track adopted by the United Nations in 2015 and are guided by our progress against these goals, we made it a brand standard forevaluation of the social and environmental issues that are critical to the long-term success of our hotels to use LightStay, our proprietary and award-winning ESG measurement and management platform. See the 2030 Goals page ofbusiness. For more information, see our ESG website (www.esg.hilton.com) for more information on our Travel with Purpose 2030 Goals.(esg.hilton.com).

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

SEEKING APPROVAL OF MORE AMBITIOUS SCIENCE-BASED TARGETS

to reduce our greenhouse gas emissions, which are under review with the SBTi

| | RECEIVED 100% RATING ON THE HUMAN RIGHTS CAMPAIGN'S CORPORATE EQUALITY INDEX

for eighth year in a row

| | CREATED A MENTAL WELLNESS HUB

to equip Team Members with effective wellness resources and normalize conversations around mental health

| | REDUCED SINGLE-USE PLASTICS

by continuing to eliminate the use of miniature toiletry bottles at all hotels by the end of 2023

|

| | | | | | |

| | | | | | |

| | | | | | |

COMPLETED ISO 14001, ISO 9000, AND ISO 50001 RECERTIFICATION OF OUR PORTFOLIO OF HOTELS

continuing as one of the largest ISO certified portfolio of hotels in the world

| | JOINED THE TENT COALITION FOR AFGHAN REFUGEES

committed to provide job opportunities for Afghan nationals displaced by the 2021 humanitarian crisis

| | HELD 10th ANNUAL HILTON EFFECT WEEK

to inspire social and environmental volunteer efforts from our Team Members around the world

| | Named TRENDSETTER in political disclosure and accountability on the CPA-Zicklin Index

|

| | | | | | |

| | | | | |

| OUR ENVIRONMENTAL IMPACT: WATTS, WATER, WASTE | |

|

We are strivingAs climate science continues to pave the way to a net-zero future for the hospitality industryevolve, we reevaluated our environmental 2030 Goals and are committed to significantly reducing the environmental impact of our hotels and operations by 2030 through energy and carbon management, water stewardship, waste reduction and sustainable sourcing. We wereset more ambitious targets in 2022. Hilton was the first major hospitality company to set science-based targets to reduce our greenhouse gas emissions and in 2021 revised our commitments to more ambitious targets in line with the latest climate science. These new targets are currently under review withthat were validated by the SBTi and will be made public in 2022. Our hotels track their energy,to obtain revalidation by the SBTi. In 2022, the SBTi verified our near-term targets (1.5°C by 2030) to cut carbon emissions intensity of our managed portfolio by 75 percent and of our franchised hotel portfolio by 56 percent, with 2008 as our baseline. We continue to work toward our 2030 Goal of reducing water and waste data in LightStay,intensity at the hotels we operate, including those that are owned, leased and managed, by 50 percent, with 2008 as our baseline.

We primarily generate carbon emissions from the operation of our hotels. As illustrated by the reductions below, we are requiredmaking steady progress to implement ongoing projects to improve the efficiency of their properties.

2021 Environmental Highlightsachieve our updated 2030 Goals.

| | | | | | | | | | | | | | | | | | | | |

Reductions in Environmental Impact Since 2008(1)(2) |

| | | | | | |

Reduction in carbon dioxide emissions per square meter: 45% | | Reduction in water consumption per square meter: 26% | | Reduction in landfilled waste per square meter: 64% | | Reduction in energy consumption per square meter: 33% |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 Environmental Highlights |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Since 2008, we have achieved the following reductions Launched an LED lighting program in environmental impact:(1)(2)

|

| | | | | | |

Carbon Emissions

-49%line with our LED global brand standard

| | Energy

-40%Announced plans to install up to 20,000 Tesla Universal Wall Connectors at 2,000 hotels, enabling guests to travel more sustainably

| | Water

-39%

| | Waste

-70%

|

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

1/3rd of the hotels we operate(1) in EMEA powered with 100% certified renewable electricity

| | 5,500+ hotels partneredPartnered with organizations to recycle and donate over 3.1 million bars of soap

| | 100%Piloted the Green Breakfast initiative, which reduced food waste across breakfast operations at participating hotels

offset of Scope 3 emissions from Hilton corporate air travel and rental cars

| |  Launched Carbon Neutral Meetings program for customers to reduce the carbon footprint of meetingsour hotels and events100% of our hotels adopted bulk amenities

| | Refreshed Energy & Water EfficientDeveloped Sustainable Design Companion Guide to support the business to make sustainable design decisions

|

| | | | | | | | | | |

(1)Reflects data as of December 31, 2023 that has been reviewed by an independent third party.

(2)Reflects performance across or including Hilton's owned, leased and managed owned and leased hotels.properties, which totaled approximately 29.8 million square meters as of December 31, 2023.

(2)2021 shows an increase in consumption against 2020 as business begins to return to pre-pandemic levels, however consumption remains below 2019 levels, and we are still on track to achieve our 2030 Goals.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG")

| | | | | |

| OUR SOCIAL IMPACT: CAREERS, COMMUNITIES, CONDUCT | |

|

Human Capital Management ("HCM")

We have built and continue to cultivate a strong employee-centered culture that createspromotes connectivity, inclusivity and trust among all Team Members. At Hilton, we are diverseMembers and has been recognized as the #1 World's Best Workplace by natureGreat Place to Work and inclusive by choice. To achieve our vision of DE&I, we have set ambitious commitments, built accountability mechanisms into our business, established strong partnerships and developed targeted training, hiring and work culture development programs to cultivate diverse talent, and will disclose our progress annually on our diversity website (jobs.hilton.com/diversity)Fortune magazine. Hilton is committed to achieving global gender parity and 25% U.S. ethnic representation at our corporate leadership levels by the end of 2027. In 2021, we achieved 2% increases in both global representation of women and U.S. ethnic representation, resulting in 39% women and 19% ethnic diversity. We hold our leaders accountable through our organizational strength objectives, which are tied to their compensation, to measure their performance against our representation goals. Even as 2021 was one of our most challenging years, we chose to make strategic investments for our Team Members underUnder the umbrella of our Thrive at Hilton Team Member value proposition, our goal is to enable Team Members to grow and flourish in both their professional and personal lives. To that end, we continued to make strategic investments for our Team Members in 2023, including:

•Evolving our programsbased on Team Member feedback helped us make decisions based on what matters most, shaping everything fromto best support their changing needs. For example, we expanded our safe returnglobal “Care for All” wellness platform by introducing a new suite of Mental Wellbeing resources globally to the workplace to rolling out a all Team Members, as well as individuals at franchised hotels. We also launched new Thrive at Hilton mental wellness platform with access to a free, dedicated counselorclinical resources in the U.S., including offerings to support musculoskeletal care and substance use disorder.

•Continuing to focus on attracting top talent, by providing meaningful and personalized experiences throughout the Thrive Global apprecruiting process. Through our employer brand campaign “Every Job Makes the Stay,” we showcase the experiences and an internal hub with a varietyimpact of mental health resources, including leader testimonials and ways to seek clinical support if needed

•Supporting our Team Members’ healthMembers in order to attract talent from all backgrounds. Additionally, we introduced new channels to build our talent pipeline, including “Launch” our early talent development program with over 3,000 applications and wellbeing by providing COVID-1921 offers accepted, and vaccine education programsin collaboration with Tent Partnership For Refugees, we are committed to creating career pathways for 3,000 refugees across the U.S. and Europe, further enriching our culture.

•Accelerated training, development and growth for our Team Members. We created over 860,000 learning and growth opportunities in 2023 for a total of 1,537,700 since 2022, making progress towards our 2030 Goal of 5 million. We expanded our mentoring efforts, enhanced our leadership development programs for 8,200 Team Members and launched the People Leader Essentials hub, a self-paced curriculum for all Team Members with content on the front lines all around the world, safely re-opening our corporate officeskey leadership topics. Rather than a one-size-fits-all approach, we create custom-curated experiences so that Team Members can learn, develop, lead and opening an onsite clinic at our Memphis operations center

•Further enhancing Thrivethrive at Hilton by expanding two of our largest recognition programs, the CEO Light & Warmth Award and Hospitality Heroes Award, and by launching flexibility programs to create time to recharge including Thrive Mini Sabbatical. We also encourage our Team Members to recharge through our Go Hilton travel program, which offers significantly discounted hotel rates

•Continuing to build on ourfollowing a training and development programs with new trainingcareer path best suited to upskill, reskilltheir goals and provide pathways to new roles and careers, increasing internal mobility, expanding our formal mentoring programs for General Managers and corporate leaders and launching General Manager Academy with partners such as Cornell University, Harvard and LinkedIn. Further, we were the first company in our industry to partner with Guild Education to provide Team Members the opportunity for debt-free continuing education

•Investing in programs that honor diverse talent and help to create an environment where they can thrive, including allyship training, our Team Member Resource Groups, Courageous Conversations learning sessions, mentorship and benefits that encourage diversity

2021 Social Highlightsaspirations.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 HCM Highlights |

| TEAM MEMBERS | | | | | | | | | |

| | | | COMMUNITY | | | | | | |

Enhanced our Thrive at Hilton "Care for All" platform worldwide by expanding offerings, including mental wellbeing and addiction resources | | | | | | | |

| | | |

Impact in our Communities:

190,000+ volunteer hours

from our global

Our Go Hilton Team Member community Nearly $2 million

inTravel program generated contributions of $4.7M+ to support the Hilton EffectGlobal Foundation

grants distributed

600+ Team Members

supported through our

and Team Member Assistance Fund | | 120,000+ meals

donatedIntroduced "Launch" our early talent development programdesigned to those in need

2,500+ Supplier Diversity

Program Partners

|

Health and Wellbeing: | | Recognition and Flexibility: | |

First hospitality company to partner

with Amazon Care

Rolled out a new Thrive at Hilton

mental wellness platform

with a dedicated counselor,

develop the Thrive Global app and an internal resource hubfuture of Hilton's corporate leaders

| | | |

| Expanded twoContinued expansion of our largest

recognition programs,

Employee Stock Purchase Plan ("ESPP") outside the CEO Light & Warmth Award & Hospitality Heroes Award

Launched flexibility programs

including Thrive Mini Sabbatical

| |

| | | | | | |

| | | | | | |

| | | | | | |

DE&I, Learning & Development: | |

| | | |

Continued Courageous Conversations learning sessions with

DE&I thought leaders reaching

10K+U.S. so that more Team Members to datecan purchase Hilton stock at a 15% discount

| | Our Team Members completed

225K+ online courses

to further their growth

Created 860k+ learning and developmentcareer growth opportunities via our programs such as Guild Education, Hilton University and Lead@Hilton | | 16,900+ Team

Members participated in Increased Team Member Resource Groups acrossGroup membership by 39% YOY, helping to bring together Team Members with shared backgrounds or interests and driving inclusivity

250 chapters worldwide

| |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 Community Highlights |

| | | | | | | | | | |

| | | | | | | | | | |

Introduced Hilton Cares, a program that will award $500,000 in scholarships and financial assistance for team and community members passionate about building and growing a career in hospitality | | Reported approximately 377k volunteer hours from our global Team Member community | | Awarded over $4.4 million in Hilton Global Foundation grants to organizations supporting destination stewardship, climate action, career development and community resilience | | Supported 3,400+ individuals through our Team Member Assistance Fund | | Supported Maui wildfire relief efforts with nearly $500,000 contributed to local organizations, in addition to over 600 daily meals provided in collaboration with World Central Kitchen | | Announced commitment to hire 1,500 additional refugees for a total of 3,000 hires in partnership with Tent Partnership for Refugees |

| | | | | | | | | | |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG")

| | | | | |

| OUR GOVERNANCE: PUBLIC AFFAIRS, PARTNERSHIPS, POLICIES & REPORTING | |

|

ESG GOVERNANCE STRUCTURE

| | | | | | | | |

| •Works with the business to set Hilton's strategic direction •Ensures the business is managed ethically and responsibly | •Oversees Hilton's ESG performance, including reviewing the Company's ESG strategy on an annual and as-needed basis

|

•Reviews and assesses the Company's ESG strategy, practices and policies, and makes recommendations to the Board as appropriate | |

•Executive Committee ("EC") approves major ESG programs and monitors progress towards 2030 Goals •CEO is accountable for ESG-related issues and decisions | •Our EVP of Corporate Affairs oversees Hilton's ESG strategy and reporting efforts, is a member of the EC and reports directly to the CEO |

•Establishes and oversees implementation of ESG and Hilton Global Foundation strategies, and serves as subject matter experts on integration of ESG into overall business objectives | •Continually assesses and reports progress against 2030 Goals |

| Hilton integrates Travel with Purpose into our business using multiple governance mechanisms including: |

•Policies, standards and requirements •EC pay is tied to ESG performance •Cross-functional working groups | •Committees, advisory boards and networks •Trainings, webinars and other presentations |

In 2021, we participated in advocacy efforts to advance legislation related to anti-human trafficking, immigration reform, climate action, plastic elimination, skills training and apprenticeship programs and DE&I. Our ESG and human rights due diligence program isefforts are supported by a robust governance structure, designed to ensure that vendors meet Hilton’s standardsour ESG objectives are an important part of our business and maintain those standards duringstrategic priorities as we work towards our 2030 Goals. Our EVP of Corporate Affairs oversees Hilton's ESG strategy and reports directly to our Chief Executive Officer, and our EC receives at least quarterly updates on our ESG programs and progress towards our 2030 Goals. The Nominating & ESG Committee, one of the contract term. Vendorsthree standing committees of Hilton's Board of Directors, receives quarterly reports on progress towards our 2030 Goals, reviews and assesses our ESG strategy and makes recommendations to the Board and management as appropriate. The Board of Directors also must comply with Hilton’s Responsible Sourcing Policy, which includesreceives annual updates on progress towards our Human Rights Principles.2030 Goals.

| | | | | |

| RECOGNITION FOR OUR AWARD-WINNING ESG PROGRAMS | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Named#1 World's Best Big Companies to Work ForWorkplace and #1 Best Workplace for Women in the U.S. by Great Place to Work and #3 World's Best Workplace –

highest ranked hospitality company Fortune magazine

| | Recognized as Fair360's #1 Top 50 Companies company for Diversity – 7th year in a row on the listEmployee Resource Groups, People with Disabilities and ESG

| | Recognized as a global sustainability leader by being included on the Dow Jones Sustainability Indices for the 5th7th year in a row | | Recognized by IR Magazine for "Best ESG Reporting - Large Cap" in 2023 | | NamedTrendsetterReceived 100% rating in political disclosure and accountability on the CPA-ZicklinCorporate Equality Index from the Human Rights Campaign for the 10th year in a row

|

| Hilton is the only company to be ranked #1 on the DiversityInc and

Great Place to Work Fortune 100 Best Companies to Work For lists

| | |

Our efforts are further described in our 20212023 ESG Report, which can be found on the Our Reporting page of our ESG website (www.esg.hilton.com)(esg.hilton.com), has been prepared in accordance with the Global Reporting Initiative ("GRI") Standards, and integratesintegrating the standards and recommendations of the Sustainability Accounting Standards Board ("SASB") and the Taskforce on Climate-related Financial Disclosures ("TCFD"). Also, see "Part I—Item 1. Business—Environmental, Social and Governance" of our Annual Report on our Form 10-K for the fiscal year ended December 31, 2021.2023.

BOARD MATTERS, DIRECTOR INDEPENDENCE AND INDEPENDENCE DETERMINATIONS

Our Board oversees the management of our business and affairs, as provided by Delaware law, and conducts its business through meetings of the Board and three standing committees: the Audit Committee; the Compensation Committee; and the Nominating & ESG Committee. Our Board has a majority of independent directors, and all of our Board’s committees are fully independent.

We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. In addition to the governance highlights noted above, other features of our corporate governance include:

•Regular executive sessions of independent directors;

•Regular and robust Board and committee evaluations led by our lead independent director;

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG")

•Active Board engagement in succession planning for executives and directors;

•No stockholder rights plan; and if our Board were ever to adopt a stockholder rights plan in the future without prior stockholder approval, we would either submit the plan to stockholders for ratification or cause the rights plan to expire within one year; and

•A range of other corporate governance best practices, including limits on the number of directorships held by our directors to prevent “overboarding,” stock ownership guidelines for our executives and directors, a robust director education program, rotation of committee members, a commitment to Board refreshment and diversity and an extensive director nominee selection process.

Under our Corporate Governance Guidelines and rules of the New York Stock Exchange (“NYSE”), a director is not independent unless the Board affirmatively determines that they do not have a direct or indirect material relationship with us or any of our subsidiaries. In addition, the director must meet the bright-line tests for independence set forth by the NYSE rules.

Our Corporate Governance Guidelines define independence in accordance with the independence definition in the current NYSE corporate governance rules for listed companies. Our Corporate Governance Guidelines require the Board to review the independence of all directors at least annually.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG")

In the event a director has a relationship with the Company that is relevant to their independence and is not addressed by the objective tests set forth in the NYSE independence definition, the Board will determine, considering all relevant facts and circumstances, whether that relationship is material.

Our Board affirmatively determined that each of Ms. Begley, Mr. Carr, Ms. Healey, Mr. Mabus, Ms. McHale, John Schreiber (who retired from our Board as of December 31, 2021), Ms. Smith and Mr. Steenland is independent under the guidelines for director independence set forth in our Corporate Governance Guidelines and under all applicable NYSE guidelines, including with respect to committee membership. Our Board also has determined that each of Ms. Begley, Mr. Mabus and Mr. Steenland is “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

In making its independence determinations, the Board considered and reviewed all information known to it (including information identified through annual directors’ questionnaires).

BOARD STRUCTURE

Our Board of Directors is led by Mr. Steenland, our lead independent director, and Mr. Gray, our Non-Executive Chair. The Chief Executive OfficerCEO position is separate from the Chair position. Although we believe that the separation of the Chair and Chief Executive OfficerCEO positions is appropriate corporate governance for us at this time, our Board believes that the Company and stockholders are best served by maintaining flexibility to determine whether and when the Chair and CEO positions should be separate or combined to provide the appropriate leadership. Responsibilities of our lead independent director include:

•Serving as a liaison between the Chief Executive OfficerCEO and independent and non-managementnon-employee directors;

•Advising as to the scope and production of Board materials;

•Managing our Board’s self-evaluation process;

•Providing input on meeting agendas;

•Chairing executive sessions of independent directors;

•Monitoring communications between stockholders and our Board; and

•Consulting on corporate governance matters.

Our Board appointed a new Nominating & ESG Committee Chair in November 2017 and new Audit and Compensation Committee Chairs in 2018 as part of a practice to refresh committee leadership from time to time.

BOARD COMMITTEES AND MEETINGS

The following table summarizes the current membership of each of the Board’s standing committees.

| | | | | | | | | | | |

| Name | Audit Committee | Compensation Committee | Nominating & ESG Committee |

| Christopher J. Nassetta | | | |

| Jonathan D. Gray | | | |

| Charlene T. Begley | Chair | | X |

| Chris Carr | | | X |

| Melanie L. Healey | | X | | X |

| Raymond E. Mabus, Jr. | X | | |

| Judith A. McHale | | Chair | | Chair |

| Elizabeth A. Smith | | | Chair |

| Douglas M. Steenland | X | X | |

We expect all directors to attend all meetings of the Board, meetings of the committees of which they are members and the annual meeting of stockholders. During the year ended December 31, 2021,2023, the Board held five meetings, the Audit Committee held eight meetings, the Compensation Committee held four meetings and the Nominating & ESG Committee held four meetings. In 2021,2023, each of our director nominees attended at least 75% of the meetings of the Board and committees on which they served as a member. We expect all directors to attend any meeting of stockholders. All of our directors attended the 20212023 Annual Meeting of Stockholders.

| | | | | | | | |

| Hilton | PROXY STATEMENT | 1311 |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG")

COMMITTEE MEMBERSHIP

AUDIT COMMITTEE

All members of the Audit Committee have been determined to be “independent,” as defined by our Corporate Governance Guidelines and the NYSE listing standards applicable to boards of directors generally and audit committees in particular. Our Board also has determined that each of the members of the Audit Committee is “financially literate” within the meaning of the listing standards of the NYSE. In addition, our Board has determined that each of Ms. Begley and Mr. Steenland qualifies as an audit committee financial expert as defined by applicable SEC regulations.

The duties and responsibilities of the Audit Committee are set forth in its charter, which may be found at www.ir.hilton.com under Investors: Corporate Governance: Governance Documents: Audit Committee Charter, and include among others: